Shopify Inc stands as a top e-commerce leader as it brings a complete commerce system to help businesses of any size succeed. Shopify provides latest market updates as its company value stands at $102.49 and attracts investment coverage from audiences worldwide. This publication includes precise projections for the upcoming five years until 2030 along with short-term predictions for 2025. We study both financial data and market trends plus forecast development triggers to explain how various investment plans could succeed.

Table of Contents

1. Introduction

Shopify as a commerce platform leader provides companies new ways to build and manage their online stores. The company’s platform serves retailers worldwide because it makes basic tasks like managing products and orders plus keeping good customer relationships much easier. As a business that reached $132.71 billion in market value Shopify grew strongly and keeps developing new solutions for their customers.

This forecast leverages data from multiple respected sources such as MarketWatch, Stock Analysis, TipRanks, and Exla Resources. Combining historical data with recent analyst updates, we aim to provide an objective, technical, and investor-focused results.

2. Key Metrics & Market Sentiment

Understanding the fundamentals is essential before exploring future price targets. Below is a table summarizing the latest key metrics for Shopify:

| Metric | Value | Notes |

|---|---|---|

| Current Stock Price | $102.49 | As of March 7, 2025 |

| Market Capitalization | $132.71B | Reflects Shopify’s large-scale market presence |

| Revenue (TTM) | $8.88B | Up 25.78% YoY |

| Net Income (TTM) | $2.02B | A significant increase from the previous year |

| EPS (TTM) | $1.55 | Strong earnings per share |

| PE Ratio | 66.12 | Forward PE ratio of 68.46 indicates growth expectations |

| Beta | 2.60 | Higher volatility compared to market average |

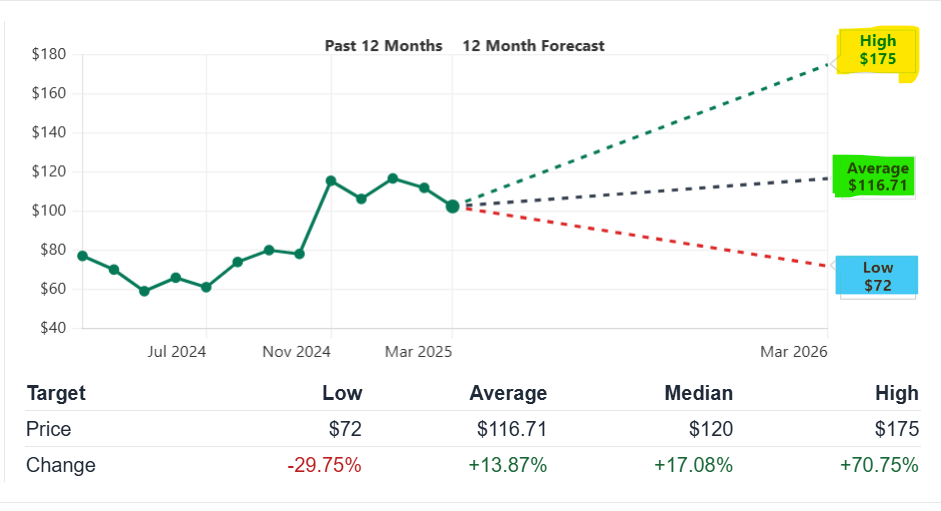

| Analyst Consensus | Buy | Average target price around $116.71 (13.87% upside) |

Data sourced from company financials and market analysis platforms such as Yahoo Finance.

Investors show positive market attitude although they handle momentary market ups and downs. Analysts recommend buying Shopify stock because of the company’s ongoing success with customer growth and international expansion plus technical updates. Shareholders value how Shopify is adding artificial intelligence to its platform plus its new PayPal deal because these developments will affect income reporting positively.

3. Short-Term Price Predictions (2025)

5-Day to 1-Month Forecast

The short-term guidance of Shopify for 2025 depends on planned earnings announcements and customer reception to new products. The market data shows technical signs of a small upward movement from price drops with buying zones between $100 to $110.

Market analysts predict Shopify will regain small growth over the upcoming five trading days. The next month should see rising Shopify prices because its earnings updates and economic developments will help performance. In summary:

- 5-Day Forecast: Expected to trade between $100–$105 as short-term support emerges.

- 1-Month Forecast: Projected range is $105–$112, aligning with technical resistance levels and initial earnings optimism.

Drivers Behind the Short-Term Forecast

Several factors underpin the short-term projections:

- Earnings Announcements: Shopify’s corporate results for February 11, 2025 will showcase substantial sales expansion based on history. In earlier reports revenue kept climbing further than predicted estimates by a range of 25% to 30%. These strong results were key in building market faith.

- Technical Indicators: The market relies on 50- and 200-day moving averages positioned at $112.27 and $86.49. The different time periods of technical supports and trends help determine how prices move next.

- Analyst Upgrades: Research firms Wedbush and Loop Capital increased their support for the company which boosted market feelings. The news publication Barrons (0news31) now shows an analyst upgrade that leads to an elevated price target at $125.

- Market Sentiment: How market investors feel about technology stocks and overall market conditions affects this industry. Even small market declines do not discourage investors from backing e-commerce platforms because they maintain strong sales performance.

4. Long-Term Price Predictions (2025–2030)

Yearly Forecast Summary

The projections run from 2025 through 2030 and combine basic business development with technology advancements. The marketplace position combined with Shopify’s technology updates and business growth into international markets will create steady increases in its operations according to analyst predictions. Our table displays future estimated target ranges.

| Fiscal Year | Low Estimate | Average Estimate | High Estimate | Notes |

|---|---|---|---|---|

| 2025 | $110 | $116–120 | $125 | Supported by near-term earnings and upgrades |

| 2026 | $120 | $130–135 | $140 | Continued revenue growth and enterprise push |

| 2027 | $125 | $135–140 | $150 | Expansion in international markets |

| 2028 | $130 | $140–145 | $155 | Integration of AI and tech enhancements |

| 2029 | $135 | $145–150 | $160 | Strategic initiatives drive margins higher |

| 2030 | $140 | $142–150 | $171 | Bullish outlook with full integration of tech |

Long-Term Catalysts

Several key factors could drive Shopify’s long-term performance:

- Growing Revenue: These efforts will lead to more revenue for Shopify due to international expansion and sharpening of its merchant base. It is expected that significant contribution is to be made through expansion into Europe and Asia-Pacific.

- AI Enabled Features: Expected to optimize operations for merchants as well as enhance margins: Shopify Magic, and other such Tech advancements. The platform also provides further enhancements in analytics as well as automatic marketing tools.

- Entering Enterprise Market: Shopify can try to capture higher value contracts by going after larger businesses and developing the necessary suite of enterprise solutions to gain their trust. This move may offset competitive pressures from existing players.

- Selling new strategic partnerships: Payment processors (e.g., PayPal) and logistic partners can not only increase gross merchandise volume but also facilitate the operation. More recent changes in revenue recognition policy with regards to these partnerships may also improve the look of the numbers.

- In an ever changing e-commerce environment, subscription services and digital tools can be a constant and maintain investor interest, but only if they are both newly developed and in the market. Strong long term drivers are product upgrades, together with favorable market cycles.

5. Technical Analysis

Technical analysis provides additional insight into Shopify’s potential price trajectory. Let’s review the key indicators:

Moving Averages

- 50-Day Moving Average: Currently near $112.27. This level acts as a resistance in the short term and a support in a recovering market.

- 200-Day Moving Average: Positioned at $86.49. A robust long-term support that indicates overall market sentiment remains positive.

The crossover between short-term and long-term averages often signals changes in momentum. Presently, the gap suggests that Shopify may experience consolidation before breaking out.

Momentum Indicators

- Relative Strength Index (RSI): The RSI is at 37.22, indicating the stock is near oversold territory. A move toward the mid-40s could signal a turnaround.

- Volume Trends: Average trading volume over the past 20 days is about 10,265,976 shares. Increased volume typically accompanies price breakouts or significant news.

Volatility Analysis

- Beta: At 2.60, Shopify exhibits higher volatility than the broader market. This suggests that while there is potential for significant upside, risk is also amplified.

- Short Interest: Approximately 1.67% of outstanding shares are sold short, a modest figure that implies limited bearish sentiment.

Below is a summary table for key technical indicators:

| Indicator | Value | Interpretation |

|---|---|---|

| 50-Day Moving Average | $112.27 | Short-term resistance/support level |

| 200-Day Moving Average | $86.49 | Long-term support; bullish indicator if maintained |

| Relative Strength Index (RSI) | 37.22 | Approaching oversold, potential for rebound |

| Beta | 2.60 | Higher volatility relative to market |

| Average Volume (20 days) | ~10.27M shares | Indicates healthy trading activity |

6. Investment Potential & ROI Scenarios

The stock’s potential returns depend on the investment horizon and to evaluate that, we need to consider different horizons. In the following, we propose ROI scenarios for short term, medium term and long term investments.

Short-Term Investment: 1 Month

Investors may be hoping for a small gain on the stock if it rebounds from its downwards dip in the next month. If we take into account how much closer the forecast $105–$112 range is to the current price of $102.49 instead of a month later, the short term investor gets 3–10% ROI from a purchase at the current price of $102.49 if the price reaches the upper end of the range. Such short-term moves could be caused by market catalysts such as the earnings report that is coming up or even a technical breakout.

Medium-Term Investment: 1 Year

If Shopify continues its strategic initiatives and that earnings reports maintain their favor, it could be more lucrative to hold on to the stock (as opposed to selling it) for a period of a year. A medium term investment should yield a return in the range of 25–30% annually if the price estimate in 2026 turns out to be around $130–$135. Such a return would indicate continued growth in revenue, whereby market penetration has increased, all riding on supporting technical trends.

Long-Term Investment: 5 Years (2030)

The growth catalysts seem to be stronger for long term investors with 2030 horizon. According to forecasts, Shopify’s stock could range from $140 to $171 by 2030 with the average target being closer to mid-$140. This equates to 35–66% on top of the current price of $102.49 if the current price is taken. The stock’s higher beta foreshadows price movement, but there’s a big case for patient investors to stay on board, given the company’s long-term growth potential; from international expansion, enterprise adoption and technological innovation.

Below is a simplified ROI table:

| Investment Horizon | Entry Price | Target Price Range | Estimated ROI |

|---|---|---|---|

| Short-Term (1 Month) | $102.49 | $105–$112 | ~3–10% |

| Medium-Term (1 Year) | $102.49 | $130–$135 | ~25–30% annualized |

| Long-Term (5 Years) | $102.49 | $140–$171 | ~35–66% cumulative |

These scenarios are based on consensus forecasts from sources including WalletInvestor and StockScan. Actual returns may vary with market conditions.

More From Money Stockers:

- SERV Robotics Stock Price Prediction, Forecast and Analysis (2025-2030)

- Rivian Automotive Stock Price Target and Forecast (2025-2030)

- The Walt Disney (DIS) Stock Forecast, Prediction and Analysis 2025, (2026-2030)

- NVIDIA Corporation (NVDA) Stock Forecast and Price Target (2024–2030)

- ANC Stock Price Target and Forecast 2025 to 2035

7. Monthly Forecast Breakdown (2025)

A granular monthly forecast helps investors understand near-term fluctuations and identify potential entry points. Here’s an estimated monthly breakdown for 2025:

March 2025

- Expected Range: $104 – $108

- Drivers: Early-year optimism and technical support at lower moving averages could prompt a modest rebound. Investors are closely watching market reaction to recent earnings guidance and technical momentum.

April 2025

- Expected Range: $106 – $110

- Drivers: Continued recovery from short-term lows as positive sentiment builds around Shopify’s enterprise initiatives. Technical signals suggest potential for gradual upward movement.

May 2025

- Expected Range: $108 – $112

- Drivers: With earnings reports and analyst upgrades starting to reflect in the stock’s performance, a steady increase is anticipated. A rising trend in moving averages may support higher price levels.

November 2025

- Expected Range: $112 – $118

- Drivers: As the fiscal year-end approaches, investors may factor in a year-to-date performance review. Increased merchant activity during holiday seasons and strategic product launches could push the price toward the upper limit.

Below is a summary table for monthly expectations:

| Month | Price Range (USD) | Key Influencers |

|---|---|---|

| March 2025 | $104 – $108 | Early recovery, technical support, initial earnings optimism |

| April 2025 | $106 – $110 | Continued momentum, enterprise initiatives |

| May 2025 | $108 – $112 | Earnings updates, analyst upgrades |

| November 2025 | $112 – $118 | Holiday season, fiscal review, increased merchant activity |

8. Risk Factors & Market Dynamics

Despite strong fundamentals and positive technical signals, several risks and market dynamics could affect Shopify’s stock performance:

External Risks

- Good or bad macroeconomic conditions such as a slowdown in global economic growth or a sudden change in interest rates could negatively influence investor attitudes which further lead to a reduction in discretionary spending and consequently e-Commerce volumes.

- New regulations: Data privacy, trade, or digital transactions are regulated and may increase data is aimed at or may hinder at being stored, shared or transmitted.

- Highly Competitive: The e-commerce market is very competitive. In addition to established players, there is fierce competition among all the startups emerging from their own ecosystem. Shopify could be limited in its potential for growth if any rivals made any significant competitive advantage for themselves.

Internal Risks

- Challenges in Execution Shopify will have challenges in execution as it scales its operations and learns to use advanced AI tools — any lapses in the process may hurt revenue and profit margins.

- Increasing costs, notably from the offshore arena and integration of technology, may compress margins unless offset it by organic or inorganic revenue growth.

- Reliant on Key Partnerships: Such reliance on other partners including PayPal, logistics providers, payment gateways makes the transaction volumes and revenue recognition vulnerable to disruptions or alterations these relationships.

9. Historical Performance & Analyst Ratings

Shopify’s past performance provides context for its future potential. Historical data reveals significant growth since its IPO in 2015, with dramatic increases in market cap and revenue. Key points include:

- Historical Growth: Since 2015, Shopify’s market cap has surged from under $2 billion to over $132 billion, showing a compound annual growth rate that has captivated investors.

- Earnings Performance: Recent earnings reports have consistently beaten expectations. For instance, the latest quarter saw revenue of $8.88B (up 25.78% YoY) and net income of $2.02B.

- Analyst Consensus: The majority of analysts rate Shopify as a “Buy.” The average 12-month target price is around $116.71, reflecting an expected upside of approximately 13.87% from current levels.

Below is a sample table summarizing historical stock performance and analyst ratings:

| Metric | Historical Value | Current Outlook |

|---|---|---|

| Stock Price (Recent Close) | $102.49 | Expected to rise gradually in 2025–2030 |

| 12-Month Average Target | ~$116.71 | Consensus indicates moderate to high growth |

| Revenue Growth (YoY) | 25.78% (FY 2024) | Continued robust growth forecast |

| Analyst Consensus | Buy | Most analysts remain optimistic |

10. Frequently Asked Questions (FAQs)

What is Shopify’s current stock price?

As of March 7, 2025, Shopify is trading at approximately $102.49 per share.

What are the main drivers for Shopify’s short-term recovery?

Upcoming earnings reports, recent analyst upgrades, and strong technical support levels (e.g., the 50-day moving average) are key factors behind the short-term forecast.

How does Shopify plan to sustain long-term growth?

Expansion into international markets, integration of AI tools like Shopify Magic, deeper penetration into the enterprise sector, and strategic partnerships with payment and logistics providers are expected to drive long-term gains.

What technical indicators suggest a positive outlook for Shopify?

The stock’s 50-day and 200-day moving averages, an RSI approaching oversold levels (currently at 37.22), and healthy trading volumes support a bullish technical view.

What risks should investors consider when buying Shopify stock?

Investors should be aware of external risks like economic slowdowns and regulatory changes, as well as internal risks including operational challenges and margin pressures.

11. Conclusion

The transformation of Shopify from its beginnings as a little Canadian business into an international leader in e-commerce operation remains extraordinary. Company performance data together with technical strength and favorable fueling events demonstrate that the stock will rise in both the immediate and extended periods.

The upcoming earnings announcements coupled with support at $100 and resistance near $110 create a decent window for rebound which can boost Shopify’s stock price. The company’s strategic initiatives for market expansion and AI feature integration and enterprise client acquisition will drive stock prices to reach $130 to $150 by 2026 with a projected end value of $171 by 2030.

The stock price of Shopify experiences certain degrees of market volatility that are typical for growth stocks. High market risk accompanies the potential for substantial profitability because Shopify maintains a beta value of 2.60. These conditions are undoubtedly influenced by the combined forces of macroeconomic fluctuations and competitive market dynamics. Investors must analyze these-risk-linked variables thoroughly before forming strategies which should match their tolerance for risk and their investment timeframe.

Consumers who want to pursue long-term benefits should consider investing in Shopify despite its short-term market instability. The stock shows strong fundamental stability with promising global expansion potential that investors should track closely.

Disclaimer: This article is for informational purposes only. It should not be considered financial advice. Always consult a financial professional before making investment decisions.