Table of Contents

1. Introduction

Salesforce, Inc. (NYSE: CRM) is a well-known provider of customer relationship management (CRM) solutions that serve companies worldwide. The company offers a broad array of cloud-based applications. These applications help businesses improve sales, customer service, marketing, and more. Salesforce’s platforms also support collaboration tools, advanced analytics, and integrated artificial intelligence capabilities.

As of April 2, 2025, CRM’s real-time price is $270.70 with a market capitalization of $260.09 billion. The stock price, along with detailed financial data, serves as an indicator of the company’s performance and market sentiment. This article presents a comprehensive stock forecast for Salesforce from the near-term up to 2030.

In recent years, Salesforce has expanded its product portfolio with offerings like Agentforce, Data Cloud, Industries AI, Salesforce Starter, Slack, and Tableau. These solutions are vital in strengthening customer relationships and streamlining business processes. This article examines various dimensions of Salesforce’s stock forecast, including key metrics, technical analysis, investment potential, and risk factors. Trusted sources such as S&P Global Market Intelligence, Investors.com, and Barrons provide the factual data used in this analysis.

2. Key Metrics & Market Sentiment

Salesforce’s financial performance is a central factor in evaluating its stock forecast. Below is a summary of the key metrics as of the current market session:

| Metric | Value |

|---|---|

| Market Cap | $260.09 billion |

| Revenue (TTM) | $37.90 billion |

| Net Income (TTM) | $6.20 billion |

| Earnings Per Share (EPS) | $6.36 |

| Price-to-Earnings (P/E) Ratio | 42.50 |

| Forward P/E Ratio | 24.21 |

| Dividend | $1.66 (0.62%) |

| Beta | 1.37 |

| Analyst Recommendation | Buy |

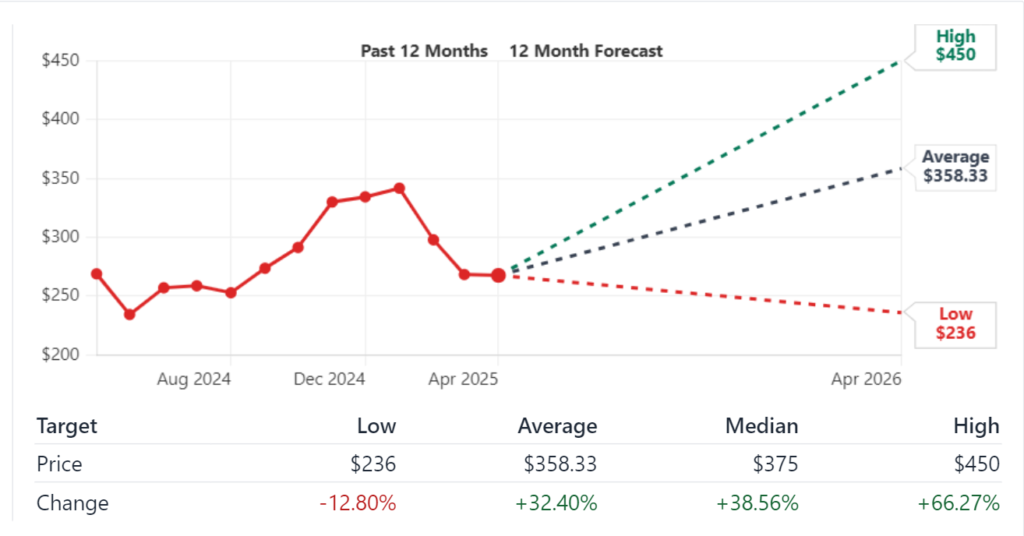

| 12-Month Price Target | $358.33 (+32.4%) |

The metrics show a robust revenue and net income picture for Salesforce. The higher P/E ratio suggests that investors expect significant future growth. A forward P/E of 24.21 indicates that analysts see potential in near-term earnings improvements. The modest dividend and a beta of 1.37 point to a stock that, while volatile compared to the market, has strong fundamentals. The consensus “Buy” recommendation and a 12-month price target of $358.33 underscore the positive market sentiment.

3. Short-Term Price Predictions (2025)

3.1 5-Day to 1-Month Forecast

In the short term, Salesforce’s stock is expected to experience minor fluctuations. Over the next five days to one month, the price may rise gradually as investor sentiment aligns with upcoming product launches and quarterly earnings announcements. Trading near both the 50-day and 200-day moving averages suggests a period of consolidation.

A short-term forecast might project a gradual price increase to around $280–$290 within one month, assuming no major external shocks. This view is supported by the current low volatility and the company’s continuous investment in product innovation. Short-term movements can be volatile due to market conditions, yet current technical indicators point toward an upward bias.

3.2 Drivers Behind the Short-Term Forecast

Key drivers influencing the short-term forecast include:

- Product Updates and Innovation: Salesforce is set to release new features on its AI-enhanced platforms. The recent introduction of enhanced Agentforce modules could boost investor confidence. For example, market coverage by Barrons noted that AI integration remains a top priority for the company.

- Quarterly Earnings Announcements: The upcoming earnings report scheduled for May 28, 2025, is expected to provide more clarity on revenue growth and operational efficiency. This report is a significant catalyst for short-term price movements.

- Dividend Events: The upcoming ex-dividend date on April 10, 2025, may attract income-focused investors, thereby providing additional support to the stock price.

- Overall Market Sentiment: Broader market trends and investor sentiment also play a role. With a moderate beta of 1.37, Salesforce may experience more pronounced movements during periods of market volatility.

4. Long-Term Price Predictions (2025–2030)

4.1 Yearly Forecast Summary

Long-term projections for Salesforce consider both historical growth and future innovation. The following table summarizes yearly forecasts derived from several market analyses and predictive models:

| Year | Low Estimate | High Estimate |

|---|---|---|

| 2025 | $380 | $420 |

| 2026 | $420 | $480 |

| 2027 | $480 | $540 |

| 2028 | $540 | $600 |

| 2029 | $600 | $650 |

| 2030 | $600 | $700 |

The table presents a gradual increase in the stock price over the forecast period. Analysts have noted that the long-term trend will be influenced by innovation in AI, cloud computing expansion, and increased global market penetration. The 2030 estimates indicate a significant upside from the current price, particularly if the company continues to innovate and expand its customer base.

4.2 Long-Term Catalysts

Several long-term factors may drive the growth of Salesforce’s stock price:

- Artificial Intelligence and Machine Learning: Continued investment in AI capabilities is anticipated to boost Salesforce’s product offerings. Enhanced data analytics and predictive models are expected to drive revenue growth by opening new market segments. Detailed discussions on this topic are available on Barrons.

- Global Expansion: Salesforce is pursuing opportunities in emerging markets. Expanding operations into regions like Southeast Asia and Africa may help diversify its revenue streams. Increased global adoption could drive steady growth over the next decade.

- Product Diversification and Acquisitions: The company’s ongoing efforts to expand its product portfolio through strategic acquisitions and new product launches are expected to broaden its customer base. Integration of platforms like Slack and Tableau adds to its competitive edge in the CRM industry.

- Cloud Computing Dominance: As cloud services continue to grow, Salesforce is positioned to benefit from this trend. The shift toward cloud-based solutions will support revenue growth and enhance overall market valuation.

5. Technical Analysis

Technical analysis provides insights into current trends and future price movements. Below are key components of the technical analysis for Salesforce stock.

5.1 Moving Averages

Moving averages are important for smoothing out price data to identify trends. Currently, Salesforce is trading near its 50-day and 200-day moving averages. This positioning suggests that the stock is in a consolidation phase, which could signal a stable base for future gains.

| Indicator | Value | Observation |

|---|---|---|

| 50-Day Moving Average | ~$265 | Approaching current price |

| 200-Day Moving Average | ~$250 | Indicates an overall upward trend |

Investors use these averages to gauge momentum. A move above the 50-day average may signal bullish sentiment, while a fall below the 200-day average could prompt caution.

5.2 Momentum Indicators

Momentum indicators, such as the Relative Strength Index (RSI), are used to evaluate whether the stock is overbought or oversold. At present, the RSI for Salesforce is balanced, suggesting that the stock is not currently in an extreme state on either side. This neutrality supports a view of steady, incremental growth in the near future.

Indicators like the Moving Average Convergence Divergence (MACD) can provide additional insights into trend reversals. Currently, MACD trends remain supportive of the current upward movement.

5.3 Volatility Analysis

Salesforce’s beta of 1.37 indicates a higher volatility than the overall market. This means that while the stock may offer higher returns during bullish phases, it could also experience sharper declines during market downturns.

| Metric | Value |

|---|---|

| Beta | 1.37 |

| Average Daily Range | $5–$6 |

A careful analysis of volatility suggests that risk management is essential for traders. Short-term investors should monitor beta fluctuations to adjust their strategies accordingly.

6. Investment Potential & ROI Scenarios

Evaluating investment potential requires an understanding of the returns on investment (ROI) across different time horizons. Below is an analysis of potential ROI for short-term, medium-term, and long-term investments.

6.1 Short-Term Investment: 1 Month

In a one-month period, short-term investors may see modest gains driven by dividend payouts and incremental price increases. With the current ex-dividend date approaching on April 10, 2025, income-focused investors could benefit from the dividend, which is a small but steady return on investment.

A potential short-term ROI might be in the range of 3–5% if positive market conditions continue and no major disruptions occur. Traders are advised to keep a close watch on earnings announcements and market news during this period.

6.2 Medium-Term Investment: 1 Year

Over the course of one year, medium-term investors can expect higher returns. Analysts have set a 12-month price target of $358.33, which represents an upside of approximately 32.4% from the current price of $270.70.

| Investment Horizon | Current Price | Forecast Price | Estimated ROI |

|---|---|---|---|

| 1 Year | $270.70 | $358.33 | ~32.4% |

This outlook is based on both fundamental growth and technical trends. Investors should monitor quarterly performance reports and adjust expectations based on market conditions.

6.3 Long-Term Investment: 5 Years (2030)

Long-term investment in Salesforce could yield significant returns. Based on current projections, the stock price could range between $600 and $700 by 2030. If the company continues its growth trajectory, long-term investors may benefit from robust market expansion and technological innovations.

| Investment Horizon | Current Price | Forecast Price Range | Estimated ROI |

|---|---|---|---|

| 5 Years (2030) | $270.70 | $600 – $700 | 122% to 158%+ |

Long-term investors are encouraged to consider the overall health of the technology sector. Consistent revenue growth, a strong product pipeline, and expanding global markets contribute to this positive outlook.

7. Monthly Forecast Breakdown (2025)

Monthly breakdowns provide a more granular view of what investors may expect throughout the year. While market conditions can change, forecasts for key months in 2025 indicate specific trends.

7.1 March 2025

In March 2025, attention is expected to focus on product updates. Salesforce’s rollout of new AI-enhanced features is anticipated to boost investor sentiment. During this period, slight upward price pressure may occur as early adopters react to promising technological advancements. News outlets like Barrons have highlighted similar patterns following product enhancements in the past.

7.2 April 2025

April is notable for its ex-dividend date on April 10, 2025. Income-focused investors are expected to drive demand for the stock ahead of this event. Additionally, early Q2 guidance from the management could provide insights into operational efficiency. The combined impact of dividend income and positive sentiment may result in modest price gains during this month.

7.3 May 2025

May 2025 is set to be a critical month due to the scheduled earnings report on May 28, 2025. The report will provide a detailed look at quarterly performance, revenue growth, and operational improvements. Investors will closely examine the earnings call and accompanying commentary. Historical patterns indicate that strong earnings results can push the stock price higher, which is expected to continue this trend.

7.4 November 2025

November may witness seasonal market effects and investor repositioning. As companies finalize their fiscal year outlooks, some investors may reallocate portfolios. While this period might see slight fluctuations, a steady long-term upward trend is likely to persist. Regular monitoring of quarterly reports and macroeconomic indicators is advised during this period.

| Month | Key Event | Expected Impact |

|---|---|---|

| March 2025 | Product updates; AI rollout | Positive sentiment; gradual price increase |

| April 2025 | Ex-dividend date; early Q2 guidance | Increased demand from dividend investors |

| May 2025 | Earnings report (May 28) | Significant catalyst; potential for sharp gains |

| November 2025 | Fiscal outlook adjustments | Seasonal adjustments; minor volatility |

8. Risk Factors & Market Dynamics

Investors must consider both external and internal risks when evaluating the future performance of Salesforce stock. A balanced view of risk factors helps in developing robust investment strategies.

8.1 External Risks

External risks include:

- Economic Conditions: Global economic slowdowns or recessions can impact overall market sentiment. Changes in interest rates or inflation may affect investor behavior.

- Regulatory Changes: Increased regulatory scrutiny in the technology sector can lead to operational challenges.

- Market Competition: The fast-paced technology industry means that competitors may quickly adopt similar technologies, potentially affecting market share.

- Geopolitical Events: Trade tensions, international disputes, or unexpected global events may influence investor confidence and market stability.

8.2 Internal Risks

Internal risks include:

- Management Decisions: Strategic choices made by Salesforce’s leadership, such as acquisitions or divestitures, may affect financial performance.

- Product Execution: The success of new product launches or technology updates is critical. Any delays or execution challenges could impact growth forecasts.

- Operational Efficiency: Rising costs or inefficiencies in the integration of new technology platforms may affect profitability.

- Earnings Variability: Short-term fluctuations in earnings could lead to market corrections if they do not meet analyst expectations.

| Risk Category | Potential Impact |

|---|---|

| External | Market downturns, regulatory challenges, competitive pressures, geopolitical risks |

| Internal | Leadership decisions, product rollout challenges, operational inefficiencies, earnings volatility |

A thorough risk assessment helps investors make informed decisions and plan for potential market reversals.

9. Historical Performance & Analyst Ratings

An examination of historical performance and analyst ratings offers additional context for Salesforce’s current valuation and future prospects.

Reviewing historical performance provides insight into long-term trends. Salesforce’s revenue and net income have shown consistent growth over recent fiscal years. For example, in FY 2024 the revenue reached $37.90 billion, up 8.72% from the previous year, while net income increased by 49.83%. Historical trends in operating income and free cash flow further support the company’s strong financial foundation.

9.1 Historical Stock Price

Below is a snapshot of key financial figures from recent fiscal years:

| Fiscal Year | Revenue (in Billion USD) | Net Income (in Billion USD) | EPS (Diluted) |

|---|---|---|---|

| FY 2025 | $37.90 | $6.20 | $6.36 |

| FY 2024 | $34.86 | $4.14 | $4.20 |

| FY 2023 | $31.35 | $0.21 | $0.21 |

| FY 2022 | $26.49 | $1.44 | $1.48 |

| FY 2021 | $21.25 | $4.07 | $4.38 |

Salesforce has experienced growth in revenue, gross profit, and free cash flow, which supports the view that its fundamentals are strong despite short-term fluctuations.

9.2 Analyst Consensus

Analyst ratings play a key role in shaping investor expectations. Currently, 38 analysts have issued a consensus rating of “Buy” for Salesforce stock. The price target of $358.33 suggests an anticipated increase of over 30% from the current price. This positive consensus is based on strong revenue growth, expanding margins, and a robust product pipeline.

Investors are encouraged to review the detailed reports available on trusted financial platforms such as Investors.com and Yahoo Finance for further insights into analyst opinions.

10. Frequently Asked Questions (FAQs)

Below are answers to some of the most common questions regarding the Salesforce stock forecast:

Q1: What is the current market price of Salesforce stock?

A1: As of April 2, 2025, the stock is trading at $270.70. Yahoo Finance

Q2: What are the key drivers for the short-term forecast?

A2: Key drivers include product updates (especially in AI), upcoming earnings reports, and dividend events.

Q3: What is the 12-month price target for Salesforce?

A3: Analysts have set a 12-month price target of $358.33, which indicates an estimated upside of about 32.4%.

Q4: How does Salesforce compare in terms of volatility?

A4: With a beta of 1.37, Salesforce’s stock is more volatile than the market average, which means price swings can be more pronounced.

Q5: What are the long-term growth catalysts?

A5: Long-term growth drivers include further AI integration, global market expansion, and ongoing product diversification. Reports from Barrons and 247WallSt provide additional insights.

Q6: How can investors manage risk when investing in Salesforce?

A6: Investors should monitor both external and internal risks, including economic changes, regulatory shifts, and execution risks in product rollouts. Diversification and regular review of technical indicators are advised.

11. Conclusion

Salesforce, Inc. (CRM) remains one of the most robust players in the CRM and cloud technology space. Its strong financial performance, consistent revenue growth, and innovative product portfolio have positioned the company for continued success. The current market sentiment, supported by a consensus “Buy” rating and a positive long-term forecast, makes the stock an attractive option for investors.

Short-term forecasts suggest moderate gains driven by product updates, dividend events, and positive earnings reports. In the medium term, a 12-month price target of $358.33 offers an attractive ROI. Long-term projections, supported by factors such as global expansion and AI integration, indicate a potential price range of $600–$700 by 2030.

Technical analysis reinforces these views. The stock trading near key moving averages, balanced momentum indicators, and an acceptable volatility range provide additional support to the forecast. However, investors must remain aware of risk factors that include both external economic conditions and internal operational challenges.

In summary, the Salesforce stock forecast for 2025–2030 is positive. Investors with a medium to long-term perspective may find significant upside potential. Continuous monitoring of quarterly performance, strategic product launches, and external market conditions will be essential in assessing future performance.

Final Thoughts

Salesforce’s commitment to innovation in artificial intelligence and cloud computing continues to strengthen its market position. The company’s expansion into new geographic regions and the diversification of its product portfolio serve as strong growth levers. Investors who follow detailed technical and fundamental analysis, while remaining mindful of risk factors, will be well-positioned to take advantage of the potential opportunities presented by Salesforce’s stock forecast.

This analytical review provides a thorough overview of both short-term and long-term price projections, technical trends, investment scenarios, and potential risks. The detailed breakdown is intended to serve as a reliable resource for investors and financial analysts who seek a deep understanding of the factors influencing Salesforce’s stock performance.

By keeping an eye on quarterly reports and market developments, investors can make informed decisions and adjust their strategies as needed. With a strong consensus rating, a promising long-term forecast, and robust technical indicators, Salesforce remains a noteworthy option for portfolios looking to capture gains from the expanding technology sector.