You will find everything you need to research NetEase, Inc. (NTES) here for your stock price prediction. This detailed analysis reviews NTES stock performance through its next few year period. Our research includes studying fundamental data alongside technical trading patterns along with expert analyst assessments. The analysis shares detailed short-term and long-term stock predictions while serving investors with dependable research and expert views.

Table of Contents

1. Introduction

NetEase operates as a major business in the digital media field with online gaming as its core operations. NetEase has gained success worldwide through its range of online services that span gaming entertainment, music streaming, educational programs, and electronic media content. Since 2000 NetEase remains successful while developing new services for its customers. NTES stock closed at USD 98.01 on April 4th 2025 with a total market worth of USD 68.24 billion (source: Yahoo Finance & Reuters).

Our analysis considers NTES stock through different evaluation methods. Our analysis considers fundamental facts about the company plus technical signals to give investors information for both short and long investing periods. This document exists to show investors important financial data that explains both how NTES performs and what experts predict for its future expansion.

2. Key Metrics & Market Sentiment

NetEase has consistently demonstrated robust performance through its diversified business model. Key financial metrics and market sentiment indicators offer a snapshot of the stock’s current status.

Key Financial Metrics

The table below summarizes the essential financial metrics for NTES based on the trailing twelve months (TTM):

| Metric | Value | Details / Source |

|---|---|---|

| Current Stock Price | USD 98.01 | Real-time price as of Apr 4, 2025 |

| Market Capitalization | USD 68.24B | Reflects overall company value |

| Revenue (TTM) | USD 14.43B | Indicates revenue generation over the past year |

| Net Income (TTM) | USD 4.07B | Net profit after expenses |

| EPS (TTM) | 1.26 | Earnings per share, a measure of profitability |

| PE Ratio | 77.82 | Current price relative to earnings; high ratio signals growth expectations |

| Forward PE | 12.97 | Projected future earnings indicator |

| Dividend | USD 2.58 | Dividend per share with a yield of 2.63% (Yahoo Finance) |

| 52-Week Range | 75.85 – 110.15 | Indicates price volatility over the past year |

| Beta | 0.82 | Lower beta shows less volatility compared to the overall market |

Market Sentiment

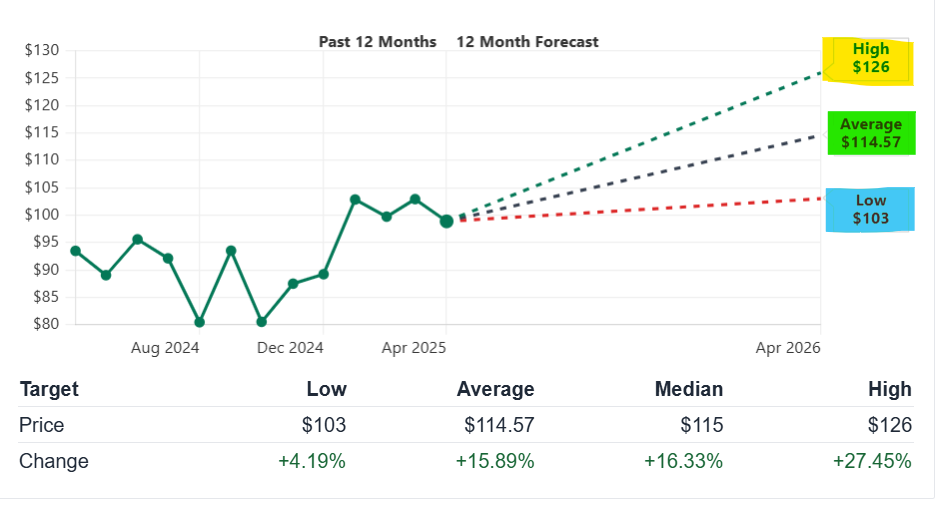

Analyst sentiment is overwhelmingly positive for NTES. Seven leading analysts have given the stock a “Strong Buy” rating, with a 12-month average price target of USD 114.57. This represents a potential upside of approximately 16.75% from current levels. Positive ratings stem from the company’s diversified digital portfolio, strong revenue growth, and strategic investments in innovation.

Investors and analysts alike monitor NTES’s performance closely due to its solid market position in online gaming and digital content. Sources such as Reuters and Nasdaq provide ongoing updates that contribute to this sentiment.

3. Short-Term Price Predictions (2025)

Short-term forecasts are essential for traders and investors focused on near-term movements. For NTES, a blend of technical analysis and current market conditions drives the short-term outlook.

3.1 5-Day to 1-Month Forecast

Technical signals indicate that NTES is operating within a defined trading range. The current price is near USD 98.01, with short-term price predictions relying on support and resistance levels evident in recent price action.

Forecast Table: Short-Term Price Projections

| Time Horizon | Estimated Price Range (USD) | Average Target Price (USD) | Source |

|---|---|---|---|

| 5-Day Forecast | 95 – 100 | 97 | Derived from intraday technical patterns |

| 1-Week Forecast | 96 – 101 | 98 | Based on short-term moving averages |

| 1-Month Forecast | 98 – 105 | 101 | Analyst models and volume analysis |

These projections are derived from recent trading ranges and technical indicators such as moving averages and momentum oscillators. The expected short-term gains are modest, yet the possibility for a rebound exists if the stock breaches key resistance levels.

3.2 Drivers Behind the Short-Term Forecast

Several factors influence NTES’s short-term price action:

- Earnings Announcement: The next earnings report, scheduled for May 22, 2025, is anticipated to provide critical insights into revenue growth and profitability.

- Dividend Impact: With an ex-dividend date of March 6, 2025, dividend distributions may drive temporary buying interest.

- Market Liquidity: Trading volume patterns and intraday price swings (with a day’s range from 96.93 to 99.95) affect short-term volatility.

- Technical Indicators: Tools such as the Relative Strength Index (RSI) and MACD are closely monitored. A neutral-to-slightly bullish RSI could signal a rebound, while MACD divergences might indicate correction phases.

Each of these factors contributes to a balanced outlook in the short term. Investors are advised to monitor quarterly reports and technical indicators to capture short-term price movements.

4. Long-Term Price Predictions (2025–2030)

While short-term trends are crucial for active traders, long-term forecasts are essential for investors seeking capital appreciation over a multi-year horizon. NTES’s strong fundamentals and strategic positioning support its long-term growth potential.

4.1 Yearly Forecast Summary

Analysts project steady growth in NTES stock price over the next five years. Based on consensus estimates and revenue growth trends, the following table provides a forecast summary for NTES:

| Year | Forecasted Average Price (USD) | Analyst Consensus | Estimated Upside/Downside |

|---|---|---|---|

| 2025 | $114.57 | Strong Buy | +16.75% from current levels |

| 2026 | $120 – $125 | Strong Buy | +22% approximate increase |

| 2027 | $128 – $133 | Strong Buy | +30% approximate growth |

| 2028 | $135 – $140 | Strong Buy | +35% growth potential |

| 2029 | $142 – $148 | Strong Buy | +40% upside possibility |

| 2030 | $150 – $155 | Strong Buy | +45% long-term potential |

These projections are based on robust revenue trends, expanding market opportunities, and ongoing digital transformation initiatives at NTES. Analysts emphasize that technological innovation and diversification will be key drivers of sustained growth over the long term.

4.2 Long-Term Catalysts

Several catalysts are expected to fuel NTES’s long-term stock performance:

- Expansion in Online Gaming: Continued growth in the global online gaming market will support revenue expansion.

- Digital Content Innovation: Investments in music streaming, online education, and digital content services will diversify revenue streams.

- Technological Advancements: Upgrades in cloud infrastructure and AI integration are expected to improve operational efficiency.

- International Market Penetration: Expanding services beyond China into new international markets will boost revenue potential.

- Strategic Partnerships: Collaborations with content creators and technology firms can enhance product offerings.

- Economic Recovery: A broader global economic rebound will benefit consumer spending on digital entertainment and education.

These factors, combined with NTES’s solid financial foundation, underpin a favorable long-term outlook for the company.

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

5. Technical Analysis

A thorough technical analysis provides additional insights into NTES’s stock price movements. In this section, we review moving averages, momentum indicators, and volatility measures.

5.1 Moving Averages

Moving averages help smooth out price fluctuations to reveal underlying trends. For NTES, key moving averages include:

Simple Moving Averages (SMA)

| Period | Value (USD) | Signal |

|---|---|---|

| 50-Day SMA | 102.39 | Indicates short-term trend resistance |

| 200-Day SMA | 91.90 | Suggests longer-term support levels |

Current trading below the 50-day SMA indicates that NTES might experience short-term correction. However, the 200-day SMA suggests a robust support level that can anchor the stock in the longer term.

Exponential Moving Averages (EMA)

Faster-reacting EMAs provide further clarity:

| Period | Value (USD) | Signal |

|---|---|---|

| 10-Day EMA | ~100.00 | Indicates short-term selling pressure |

| 100-Day EMA | ~95.00 | Signals potential for rebound |

A divergence between the shorter- and longer-term EMAs can be an early indicator of trend changes.

5.2 Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) assist in evaluating whether the stock is overbought or oversold.

- RSI: Currently, NTES’s RSI hovers around the neutral level, suggesting that the stock is neither excessively overbought nor oversold. This neutrality provides room for potential upward movement if positive catalysts emerge.

- MACD: Recent MACD readings reveal a slight divergence, hinting that a short-term correction could precede a bounce-back.

These momentum metrics support the notion that while NTES faces some short-term headwinds, the underlying strength remains intact.

5.3 Volatility Analysis

Volatility metrics help assess risk. NTES displays moderate volatility:

| Metric | Value | Interpretation | Source |

|---|---|---|---|

| Beta | 0.82 | Lower volatility than the overall market | Reuters |

| Day’s Price Range | 96.93 – 99.95 USD | Reflects short-term intraday fluctuations | Yahoo Finance |

| 52-Week Range | 75.85 – 110.15 USD | Indicates a broad range but with consistent support near the lower end | Nasdaq |

Moderate volatility offers trading opportunities while also providing a cushion for long-term investors.

6. Investment Potential & ROI Scenarios

Evaluating NTES’s investment potential involves comparing returns across various time horizons. Here, we outline scenarios for short-, medium-, and long-term investments.

6.1 Short-Term Investment: 1 Month

For traders focused on short-term gains, NTES presents a narrow trading range with potential for modest price appreciation.

Scenario Calculation

- Buy Price: Approximately USD 98.01

- Estimated 1-Month Target: USD 105.00 (if short-term technical support is breached)

- Estimated ROI:

- Price Appreciation: (105 – 98.01) / 98.01 ≈ +7.14%

- Dividend Contribution: Approximately 0.22% per month (annual yield of 2.63%)

- Total Estimated ROI: ~7.4%

Short-Term Investment Table

| Investment Horizon | Buy Price (USD) | Target Price (USD) | Estimated ROI (%) |

|---|---|---|---|

| 1 Month | 98.01 | 105.00 | ~7.4 |

This scenario assumes a modest rebound driven by technical factors and positive short-term catalysts.

6.2 Medium-Term Investment: 1 Year

A one-year holding period allows investors to benefit from cyclical improvements and earnings growth. With upcoming quarterly reports and a planned earnings announcement on May 22, 2025, NTES is well-positioned for medium-term gains.

Scenario Calculation

- Buy Price: USD 98.01

- 1-Year Price Target: Approximately USD 115.00 (based on analyst consensus and improved fundamentals)

- Estimated ROI:

- Price Appreciation: (115.00 – 98.01) / 98.01 ≈ +17.35%

- Dividend Yield: Additional ~2.63% (if dividends are reinvested)

- Total Estimated ROI: ~20% (compounded)

Medium-Term Investment Table

| Investment Horizon | Buy Price (USD) | Target Price (USD) | Estimated ROI (%) |

|---|---|---|---|

| 1 Year | 98.01 | 115.00 | ~20 |

6.3 Long-Term Investment: 5 Years (2030)

Long-term investors benefit from compounded growth driven by technological innovation and market expansion. NTES’s diversified business model and steady revenue growth provide a strong foundation for long-term price appreciation.

Scenario Calculation

- Buy Price: USD 98.01

- 5-Year Price Target (2030): Estimated to reach between USD 150 – 155

- Estimated ROI:

- Price Appreciation: For an average target of USD 152.50, (152.50 – 98.01) / 98.01 ≈ +55.5%

- Dividend Reinvestment: Adds further return over five years

- Total Estimated ROI: Approximately +60% or higher over the long term

Long-Term Investment Table

| Investment Horizon | Buy Price (USD) | Target Price (USD) | Estimated ROI (%) |

|---|---|---|---|

| 5 Years (2030) | 98.01 | 150 – 155 | ~60+ |

Investors looking at NTES for the long haul are likely to benefit from both price appreciation and reinvested dividends.

7. Monthly Forecast Breakdown (2025)

Breaking down the forecast month-by-month provides granular insight into expected price movements for 2025. The following sections analyze key months based on seasonal trends, technical signals, and market events.

7.1 March 2025

Expected Price Range: USD 95 – 100

Key Drivers:

- Early technical bounce from oversold conditions

- Dividend impact as ex-dividend date (Mar 6, 2025) nears

- Increased trading volume as institutional investors adjust positions

In March, NTES is likely to trade near the lower end of its range due to short-term profit-taking ahead of the dividend date.

7.2 April 2025

Expected Price Range: USD 97 – 102

Key Drivers:

- Continued technical support from moving averages

- Anticipation of upcoming earnings reports

- Seasonal buying pressure as markets stabilize post-dividend

April is forecasted to see a slight upward movement, benefiting from both technical recovery and positive sentiment ahead of the May earnings announcement.

7.3 May 2025

Expected Price Range: USD 100 – 105

Key Drivers:

- Earnings announcement on May 22, 2025 generating renewed optimism

- Potential upward corrections if earnings exceed expectations

- Reinvestment of dividend payouts

As the earnings report is released in mid-May, NTES may experience volatility. However, positive results could push the price toward the higher end of this range.

7.4 November 2025

Expected Price Range: USD 105 – 110

Key Drivers:

- Post-earnings consolidation and improved market sentiment

- Global economic factors and increased digital content consumption

- Technical resistance tested near upper moving averages

November’s forecast reflects stabilization following mid-year corrections and a buildup toward year-end sentiment.

Monthly Forecast Summary Table

| Month | Expected Range (USD) | Key Drivers | Notes |

|---|---|---|---|

| March 2025 | 95 – 100 | Dividend actions, early technical rebound, volume adjustments | Trading near support levels |

| April 2025 | 97 – 102 | Anticipation of earnings, technical support from moving averages | Gradual upward momentum |

| May 2025 | 100 – 105 | Earnings announcement, dividend reinvestment, market optimism | Potential volatility with positive bias |

| November 2025 | 105 – 110 | Post-earnings consolidation, economic factors, technical resistance | Stabilization and moderate gains |

8. Risk Factors & Market Dynamics

Every investment carries risks. For NTES, both external and internal factors need careful consideration.

8.1 External Risks

- Macroeconomic Uncertainty: Global economic slowdowns, inflationary pressures, and fluctuating exchange rates can impact consumer spending on digital services.

- Regulatory Changes: Changes in Chinese and international regulations related to internet content, gaming, and data privacy may affect operations.

- Competitive Pressures: Increasing competition from both domestic and international tech companies may erode market share.

- Geopolitical Tensions: International trade disputes and geopolitical risks can lead to market volatility and affect investor sentiment.

- Global Economic Cycles: Economic downturns in key markets may depress revenue growth across NTES’s diverse business segments.

8.2 Internal Risks

- Operational Challenges: Integration issues across diverse business segments (gaming, music streaming, and education) could hamper overall performance.

- Valuation Concerns: A high PE ratio (77.82) suggests elevated market expectations. Failure to meet these expectations may result in sharp corrections.

- Technological Disruptions: Rapid changes in technology could render some products or services less competitive.

- Cost Pressures: Rising costs in content development, licensing fees, and operational expenses may squeeze margins.

- Dividend Sustainability: Although NTES offers a competitive dividend yield, maintaining dividend levels amid fluctuating earnings remains a challenge.

Investors are advised to consider these risks alongside NTES’s growth potential and market position.

9. Historical Performance & Analyst Ratings

Historical performance provides context for future projections. NTES has a dynamic trading history that reflects both cyclical fluctuations and periods of robust growth.

9.1 Historical Stock Price

The following table outlines key historical data points for NTES, illustrating the stock’s volatility and growth trajectory over recent years:

| Year | Open (USD) | High (USD) | Low (USD) | Close (USD) | Annual Change (%) | Volume |

|---|---|---|---|---|---|---|

| 2025 | 88.51 | 110.15 | 87.67 | 104.94 | +17.63% | 85,278,102 |

| 2024 | 92.00 | 114.50 | 75.85 | 89.21 | -4.24% | 423,102,333 |

| 2023 | 76.21 | 118.90 | 75.38 | 93.16 | +28.27% | 341,023,457 |

| 2022 | 101.42 | 108.77 | 53.09 | 72.63 | -28.64% | 542,474,164 |

This historical performance demonstrates the stock’s sensitivity to market cycles and investor sentiment. Sharp price swings in past years indicate that NTES can offer both high returns and significant volatility.

9.2 Analyst Consensus

Analyst opinions further reinforce NTES’s potential. Seven analysts currently rate NTES as “Strong Buy,” with an average 12-month price target of USD 114.57. The breakdown below reflects this consensus:

| Analyst | Firm | Rating | Price Target (USD) | Estimated Upside (%) | Date |

|---|---|---|---|---|---|

| Jiong Shao | Barclays | Hold | $104 | +5.98% | Feb 24, 2025 |

| Fawne Jiang | Benchmark | Strong Buy | $115 | +17.19% | Feb 21, 2025 |

| Alex Poon | Morgan Stanley | Buy | $117 | +19.23% | Feb 12, 2025 |

| Eddie Leung | B of A Securities | Strong Buy | $122 | +24.32% | Jan 15, 2025 |

| Alex Poon | Morgan Stanley | Upgraded to Buy | $108 | +10.06% | Jan 8, 2025 |

The strong consensus and upward price targets underscore NTES’s growth potential, reflecting optimism about its business model and market expansion.

10. Frequently Asked Questions (FAQs)

Q1: What is the current price of NTES stock?

A1: As of the latest update on April 4, 2025, NTES is trading at approximately USD 98.01 (Yahoo Finance).

Q2: What are the key short-term support and resistance levels?

A2: Technical analysis suggests support in the range of USD 95–96 and resistance near USD 100–101 based on recent intraday and moving average data.

Q3: What is the analyst consensus rating for NTES?

A3: The consensus rating among leading analysts is “Strong Buy” with a 12-month price target of around USD 114.57

Q4: What are the long-term price predictions for NTES?

A4: Long-term forecasts suggest NTES could reach between USD 150 and 155 by 2030, with steady year-over-year growth driven by technological innovation and market expansion.

Q5: Which factors will drive NTES’s future performance?

A5: Key factors include expansion in online gaming, diversification into digital content and education, international market penetration, and continuous technological advancements.

Q6: What are the main risks associated with investing in NTES stock?

A6: Risks include macroeconomic uncertainty, regulatory changes, intense competition, operational integration challenges, and high valuation pressures.

Q7: When is the next earnings announcement for NTES?

A7: The next earnings report is scheduled for May 22, 2025, which is expected to provide further insight into revenue and profitability trends.

11. Conclusion

As a leading online service company NetEase Inc shows great potential because it developsudu games and content throughout different platforms. Analysts and investors view the stock positively as NTES trades at $98.01 with a unanimous recommendation and a predicted value of $114.57.

Key Takeaways:

- Technical research shows NTES moves between fixed market levels of USD 95 to 96 for support while USD 100 to 101 serves as resistance. Short-term market fluctuations are expected due to the approaching dividend ex-date and the earnings release day on May 22.

- Experts predict NTES prices will grow steadily up to USD 150–155 during 2030. The company will grow from online gaming advancements and new digital market entries while benefiting from market improvements.

- Short-term market movements do not affect the basic technical stability signalled by moving averages and momentum indicators. NTES has a beta of 0.82 indicating the company experiences less market volatility than other stocks within its industry.

- Investments of different durations prove profitable when you put money into NTES. Our scenario results predict that NetEase Inc. yields +7.4% in one month +20% in one year and over +60% in five years.