Introduction and Overview

If you are looking for LLY stock price prediction with detailed technical, fundamental, stock forecast analysis. you are at right place. Here, we have analyzed Eli Lilly and Company (LLY), a major player in the Drug Manufacturers – General industry within the Healthcare sector. As of May 06, 2025, LLY trades at $775.12, reflecting its current short-term weakness relative to its moving averages. The company holds a market capitalization of approximately $674.60 B.

This detailed analytical report aims to predict stock prices along with technical examinations while providing future forecasting for 2025-2026. This report combines both historical price-related technical indicators and fundamental data examination for creating an extensive market performance forecast.

Brief Overview

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin li…

Key Metrics and Forecast Summary

$775.12

$810.26

$1,304.38 (+68.3%) ▲

● Neutral

65.1%

$810.81 ▼

$814.71 ▼

13/29 (45%)

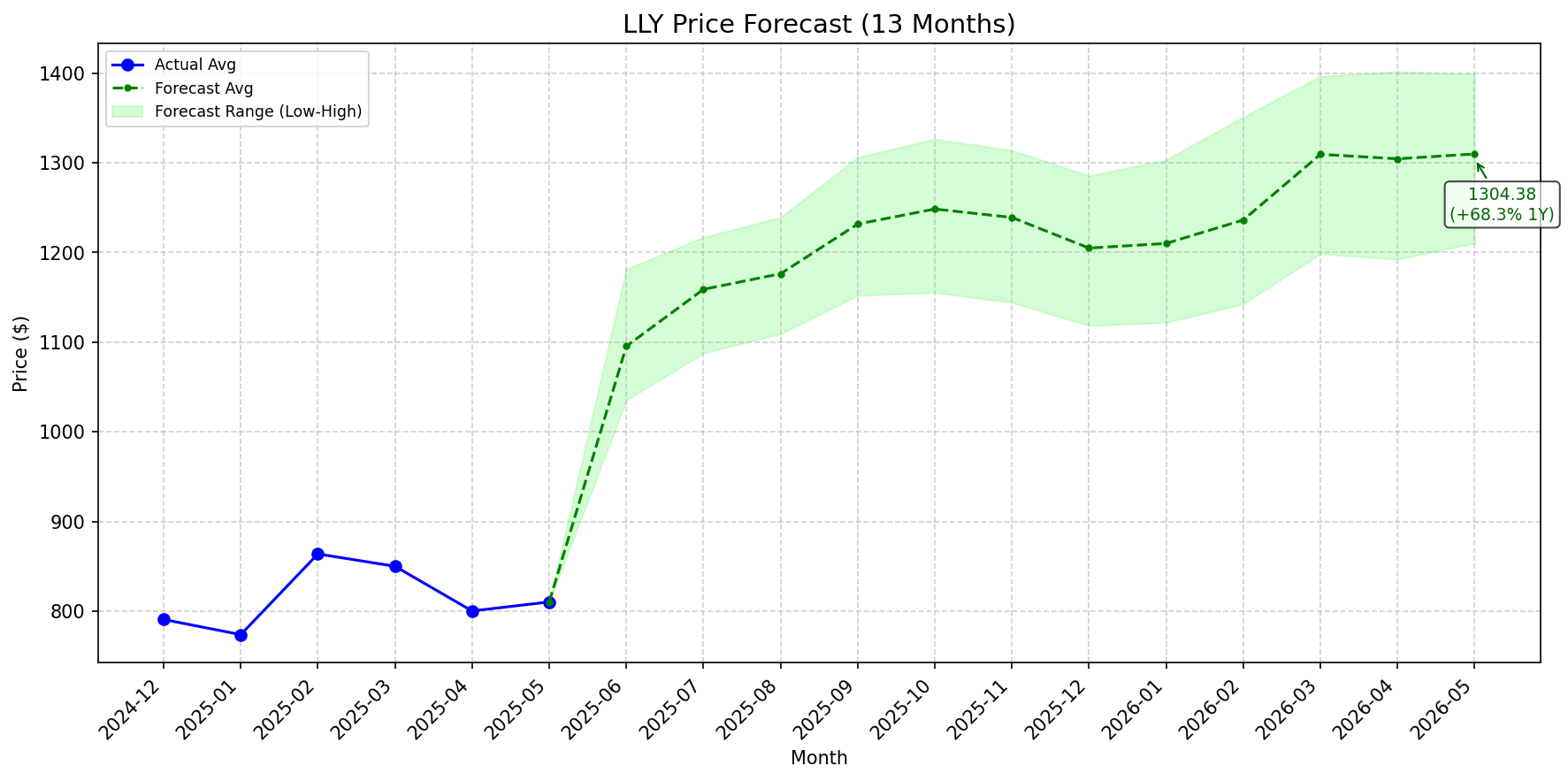

The 1-Year forecast of $1,304.38 (+68.3%) suggests modest potential upside. The 65.1% annualized volatility indicates high risk (price fluctuation). Price is below both SMA50 ($810.81) and SMA200 ($814.71), signaling bearish trends.

Detailed Forecast Table

The table below outlines the forecasted price range (Minimum, Average, Maximum) for LLY stock on a month basis.

‘Potential ROI’ (Return on Investment) is calculated by comparing the forecasted ‘Average’ price against the current stock price ($775.12).

‘Action Signal’ provides a simplified interpretation based on this ROI: ‘Buy’ if ROI > +2%, ‘Short’ if ROI < -2%, and 'Hold' otherwise. The signals originate from the forecast model prediction data exclusively.

Over the forecast period, the price is projected to fluctuate between approximately $810.26 and $1,401.52.

The widening forecast range from $810.26 – $810.26 initially to $1,210.49 – $1,398.82 towards the end of the forecast period reflects increasing uncertainty or expected volatility over time.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI | Action Signal |

|---|---|---|---|---|---|

| 2025-05 | $810.26 | $810.26 | $810.26 | ▲ 4.5% | Buy |

| 2025-06 | $1,035.29 | $1,095.39 | $1,181.30 | ▲ 41.3% | Buy |

| 2025-07 | $1,087.67 | $1,158.83 | $1,216.90 | ▲ 49.5% | Buy |

| 2025-08 | $1,109.35 | $1,176.20 | $1,239.10 | ▲ 51.7% | Buy |

| 2025-09 | $1,152.03 | $1,231.64 | $1,306.05 | ▲ 58.9% | Buy |

| 2025-10 | $1,155.24 | $1,248.37 | $1,326.29 | ▲ 61.1% | Buy |

| 2025-11 | $1,144.31 | $1,238.98 | $1,313.74 | ▲ 59.8% | Buy |

| 2025-12 | $1,118.41 | $1,204.83 | $1,285.48 | ▲ 55.4% | Buy |

| 2026-01 | $1,121.98 | $1,210.02 | $1,303.16 | ▲ 56.1% | Buy |

| 2026-02 | $1,142.58 | $1,236.18 | $1,351.12 | ▲ 59.5% | Buy |

| 2026-03 | $1,198.62 | $1,309.39 | $1,396.39 | ▲ 68.9% | Buy |

| 2026-04 | $1,192.33 | $1,304.38 | $1,401.52 | ▲ 68.3% | Buy |

| 2026-05 | $1,210.49 | $1,309.79 | $1,398.82 | ▲ 69.0% | Buy |

Company Profile

Business Summary

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity. It also provides oncology products, including Alimta, Cyramza, Erbitux, Jaypirca, Retevmo, Tyvyt, and Verzenio. In addition, the company offers Olumiant for rheumatoid arthritis, atopic dermatitis, severe alopecia areata, and COVID-19; Taltz for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and non-radiographic axial spondylarthritis; Omvoh for ulcerative colitis; Cymbalta for depressive disorder, diabetic peripheral neuropathic pain, generalized anxiety disorder, fibromyalgia, and chronic musculoskeletal pain; Ebglyss for severe atopic dermatitis; and Emgality for migraine prevention and episodic cluster headache. It has collaborations with Incyte Corporation; Boehringer Ingelheim Pharmaceuticals, Inc.; F. Hoffmann-La Roche Ltd and Genentech, Inc.; Biologics, Inc., AbCellera Biologics Inc.; Verge Genomics; collaboration with AdvanCell to advance novel targeted alpha therapies for the treatment of cancer; and Chugai Pharmaceutical Co., Ltd. Eli Lilly and Company was founded in 1876 and is headquartered in Indianapolis, Indiana.

Total Valuation

Total valuation metrics provide a broader view of the company’s worth, including debt and cash.

With an Enterprise Value of $709.99 B against its Trailing Twelve Months (TTM) revenue, LLY’s EV/Revenue ratio stands at 14.49x, which is currently above the estimated industry average (~2.5x), suggesting a potential premium valuation.

Important upcoming dates: Next Earnings around 2025-08-07, Last Ex-Dividend Date was 2025-05-16.

| Market Cap | $674.60 B |

| Enterprise Value (EV TTM) | $709.99 B |

| EV/Revenue (TTM) | 14.49x |

| EV/EBITDA (TTM) | 32.27x |

| Next Earnings Date | 2025-08-07 |

| Ex-Dividend Date | 2025-05-16 |

Valuation Metrics

Stock valuation metrics enable investors to determine the price value relationship between stock market worth and earnings along with sales, book value and anticipated growth potential.

Forward P/E of 33.16x Price/Book of 45.17x Mentoring these financial metrics to industry standards as well historical company values generates deeper understanding.

Note: P/FCF (Price to Free Cash Flow) of -370.26x is another key valuation indicator. EV/EBITDA is often used for comparing companies with different capital structures.

| Trailing P/E | 60.99x |

| Forward P/E | 33.16x |

| Price/Sales (TTM) | 13.77x |

| Price/Book (MRQ) | 45.17x |

| EV/Revenue (TTM) | 14.49x |

| EV/EBITDA (TTM) | 32.27x |

| Price/FCF (TTM) | -370.26x |

Financial Health

Companies need financial health indicators to determine their capability of handling short-term financial commitments (liquidity) and their ability to repay long-term debt (solvency) as well as their equity and asset return ratios.

- Debt/Equity ratio of 243.61x signals high leverage, indicating elevated financial risk.

- Current Ratio (1.37x) indicates relatively tight short-term liquidity. The Quick Ratio (0.57x), excluding inventory, reinforces potential liquidity constraints.

- Return on Equity (ROE) of 77.28% indicates the company’s profitability relative to shareholder investments.

- Operating Cash Flow (TTM) stands at $9.32 B, demonstrating cash generated from core operations.

These metrics act as point-in-time measurements yet understanding long-term trends delivers better understanding. ROA (Return on Assets) does not appear frequently in these financial reports.

| Return on Equity (ROE TTM) | 77.28% |

| Return on Assets (ROA TTM) | 16.45% |

| Debt/Equity (MRQ) | 243.61x |

| Total Cash (MRQ) | $3.22 B |

| Total Debt (MRQ) | $38.60 B |

| Current Ratio (MRQ) | 1.37x |

| Quick Ratio (MRQ) | 0.57x |

| Operating Cash Flow (TTM) | $9.32 B |

| Levered Free Cash Flow (TTM) | $-1.82 B |

Financial Efficiency

Financial efficiency ratios evaluate organizational asset management and working capital control (such as inventory and receivables) for generating revenue and profits.

- Specific financial efficiency metrics were not readily available.

ROIC stands as an important measurement of total capital efficiency but analysts need full financial statements to generate this metric. Monitoring should focus on equal groups in the same market sector.

| No specific data available for this section. |

Profitability and Growth

Profitability margins show how much profit is generated per dollar of sales at different stages (Gross, Operating, Net). Growth rates track the expansion of revenue and earnings over time.

- Strong recent growth (Revenue: 45.20%, Earnings: 23.40%) indicates positive business momentum.

- Gross Margin (81.70%) appears strong, while Operating Margin (42.49%) is strong. Analyzing margin trends over time is important.

Business owners should measure margins by comparing them against industry competitors and past performance records. Stock value development depends heavily on sustainable growth.

| Profit Margin (TTM) | 22.67% |

| Operating Margin (TTM) | 42.49% |

| Gross Margin (TTM) | 81.70% |

| EBITDA Margin (TTM) | 44.90% |

| Revenue (TTM) | $49.00 B |

| Revenue Growth (YoY) | 45.20% |

| Gross Profit (TTM) | $40.03 B |

| EBITDA (TTM) | $22.00 B |

| Net Income (TTM) | $11.11 B |

| Earnings Growth (YoY) | 23.40% |

Dividends and Shareholder Returns

Stock dividends together with share repurchases constitute major methods that corporations use to redistribute wealth to their shareholders. Investors who focus on income require a thorough analysis of both yield ratios and dividend sustainability.

- Dividend Yield (Forward) is 80.00%.

- Payout Ratio of 43.94% indicates a sustainable dividend with room for growth.

- This dividend profile may appeal most to income and growth investors.

- Share buybacks (Yield: N/A) also contribute to total shareholder return.

Shareholders obtain a yield consisting of dividends and buybacks according to the equation Total Shareholder Yield = Dividend Yield + Buyback Yield. Raising dividends to full potential may temporarily restrict future dividend expansion possibilities. Check Ex-Dividend Date for eligibility.

| Dividend Rate (Fwd) | $6.00 |

| Dividend Yield (Fwd) | 80.00% |

| Trailing Dividend Rate | $5.40 |

| Trailing Dividend Yield | 0.70% |

| 5 Year Avg Dividend Yield | 1.1% |

| Payout Ratio | 43.94% |

| Ex-Dividend Date | 2025-05-16 |

| Last Split Date | 1997-10-16 |

| Last Split Factor | 2:1 |

Technical Analysis

Summary based on data up to 2025-05-06. Detailed charts follow.

- Trend: Bearish Trend (Price < SMA50 & SMA200). Current Price: $775.12.

- Momentum (RSI): 40.2 (Neutral), suggesting balanced momentum.

- Momentum (MACD): Line (2.84) below Signal (11.79) (Bearish Signal). Histogram is Negative (Strengthening Bearish).

- Volatility (BBands): Price below Lower Band ($776.73), indicating high volatility / potential oversold.

- Support/Resistance (30d): ~$677.09 / ~$902.50.

Moving Average Values

Technical indicators analyze past price trends, not future guarantees.

Bollinger Bands Analysis

RSI Analysis

MACD Analysis

Historical Price & Volume

Historical closing price and volume. Range typically shows last 3 years.

Stock Price Statistics

The statistics helps you to understand the stock’s volatility along with market-related Beta value and performance range and trading liquidity.

- Beta is reported as 0.47x.

- Recent Volatility (30d Annualized) is 65.1%.

- The 52-Week Change of 2.20% reflects long-term price momentum.

Note: Beta > 1 indicates higher volatility than the market; Beta < 1 indicates lower. Average Volume shows typical daily trading activity.

| Beta | 0.47x |

| 52 Week Change | 2.20% |

| S&P500 52-Week Change | 7.82% |

| 52 Week High | $972.53 |

| 52 Week Low | $677.09 |

| 50-Day Moving Average | $826.58 |

| 200-Day Moving Average | $842.06 |

| Average Volume (10 day) | 4,797,490 |

| Average Volume (3 month) | 3,851,534 |

| Volatility (30d Ann.) | 65.1% |

Short Selling Information

Short selling data indicates the level of bearish bets against the stock.

- Short interest at 0.80% of float suggests minimal bearish pressure.

- This level indicates low short squeeze risk.

- The Short Ratio (Days To Cover) is 1.8x, meaning it would take about that many days of average volume to cover all short positions.

Note: High short interest can increase volatility. The Short Ratio helps gauge how quickly short positions could theoretically be covered. Data as of 2025-04-15.

| Shares Short | $6 M |

| Short Ratio (Days To Cover) | 1.8x |

| Short % of Float | 0.80% |

| Shares Short (Prior Month) | $6 M |

| Short Date | 2025-04-15 |

Risk Factors

Investing in LLY involves various risks. This section outlines potential factors identified through data analysis and general market considerations. It is not exhaustive.

- ⚠️ Price (775.12) is below the 50-Day SMA (810.81), indicating potential short-term weakness.

- ⚠️ Price (775.12) is below the 200-Day SMA (814.71), indicating potential long-term weakness.

- ⚠️ High Debt-to-Equity ratio (243.61x) indicates significant financial leverage risk.

- ⚠️ General market fluctuations and economic conditions can impact stocks in the Healthcare sector.

Analyst Insights and Consensus

Wall Street analysts provide ratings and price targets based on their assessment of the company’s prospects.

- The consensus recommendation from 26 analysts is ▲ Buy.

- Analysts’ mean target price of $981.63 implies potential 26.6% change from the current price ($775.12), suggesting analyst optimism.

Note: Analyst opinions are subjective and can change. Look at the range of estimates (High/Low Target) and any recent revisions for more context.

Conclusion and Outlook

Short-Term Outlook

- ●Overall Technical Sentiment: Neutral.

- ▼Price below key SMAs (50, 200), indicating bearish short/long-term trends.

- ●Neutral momentum.

- ▼MACD indicator shows Bearish momentum signal.

- ➕Price is currently below Lower Band (potential oversold/breakdown).

- ℹ️Key levels to watch: Support ~$677.09, Resistance ~$902.50.

Long-Term Outlook (1 Year)

- ▲Model forecasts ~+68.3% average change over 1 year to ≈$1,304.38.

- ⚠️Valuation appears elevated (Fwd P/E: 33.16x). (Needs peer comparison).

- ▼Fundamental health appears Weak (ROE: 77.28%, Debt/Equity: 243.61x).

- ▲Positive recent growth (Rev: 45.20%, Earn: 23.40%).

- ▲Analyst consensus: Buy.

- 💸Offers a dividend yield of 80.00%.

Overall Assessment:

Overall assessment requires careful consideration of all factors. Technicals currently show Neutral signals. Fundamentals appear Weak. The forecast suggests Potential Upside. Consider risks before investing.

This is an analysis report and not investment advice. Review all data and consult a professional.

Frequently Asked Questions

What is the LLY stock forecast for the next year?

The current 1-year average price forecast for LLY is approximately $1,304.38. This represents a potential change of +68.3% from the current price of $775.12. Keep in mind this is an estimate, and the actual price could fall within the forecast range (see table) or outside it due to market factors.

Will LLY stock go up or down?

The 1-year forecast (+68.3% potential change) suggests the stock might go up on average. However, short-term movements can differ significantly based on technical factors (Neutral) and market news. Refer to the detailed forecast table for projected monthly ranges.

Is LLY a good stock to buy now?

Current technical sentiment is Neutral (neutral leaning). The stock is currently ● neutral territory. The forecast shows a +68.3% potential 1-year change. However, 4 potential risk factor(s) were identified (see Risk section). This is not investment advice. Evaluate risks, fundamentals (like valuation, debt), and your own investment strategy. Consider consulting a financial advisor.

How volatile is LLY stock?

The recent annualized volatility for LLY is calculated at ⚠️ 65.1%, indicating high price fluctuations compared to typical market averages. Check the ‘Stock Price Statistics’ section for Beta comparison if available.

Is LLY considered expensive based on P/E ratio?

The Trailing P/E ratio is ⚠️ 60.99x. This is considered quite high relative to typical benchmarks. Refer to the ‘Valuation Metrics’ section for Forward P/E and other ratios, ideally compared to industry peers for full context.

More From Money Stockers:

- TSM 2025-26 Forecast: Technical Analysis & Price Predictions

- Is BAC a Buy? 2025-26 Stock Analysis and Price Forecast

- Analyst View on PFE: Key Predictions and Price Forecast 2025-26

- The Future of IBM Stock Price Predictions and Analysis for 2025-26

- The Future of CAR Stock Price Predictions and Analysis for 2025-26

- URI Future Stock Price & Technical Outlook 2025-26

- Analyst View on CAVA: Key Predictions and Price Forecast 2025-26

- RIVN Stock Prediction, and Price Target (2025-26) – What Experts Say