This article presents an extensive forecast and analysis of Hims & Hers Health, Inc. (NYSE: HIMS). The report examines short-term and long-term price predictions and evaluates key metrics, technical indicators, investment scenarios, and risk factors. Data is gathered from reputable financial sources to ensure accuracy and reliability.

A telehealth company that connects consumers with licensed healthcare professionals, Hims & Hers Health, Inc. has experienced notable growth in revenue and market presence. This report discusses its recent performance and the potential for future price appreciation.

Table of Contents

1. Introduction

Hims & Hers Health, Inc. is a telehealth service provider that enables access to healthcare products and services through its online platform. The company serves customers in the United States, the United Kingdom, and international markets. HIMS primarily focuses on personal wellness, prescription medications, and over-the-counter products. With a notable presence on the New York Stock Exchange, HIMS has captured investor attention with its consistent revenue growth and strategic market expansion.

The company’s recent performance shows significant improvements in revenue and profitability. Stock performance, as of March 28, 2025, reflects a trading price of USD 29.14 during the day, with after-hours trading near USD 28.94. The company currently has a market capitalization of approximately USD 6.47 billion. These figures, along with detailed financial statements and market analysis, serve as a foundation for the forecasts discussed in this article. Data is based on sources such as Yahoo Finance and S&P Global Market Intelligence.

2. Key Metrics & Market Sentiment

Investors focus on several metrics when evaluating stock potential. For HIMS, key figures are summarized in the table below:

| Metric | Value |

|---|---|

| Market Cap | USD 6.47 Billion |

| Revenue (ttm) | USD 1.48 Billion |

| Net Income (ttm) | USD 126.04 Million |

| Shares Outstanding | 222.17 Million |

| EPS (ttm) | 0.53 |

| PE Ratio | 54.75 |

| Forward PE | 45.61 |

| Dividend | n/a |

| Volume | 20,799,667 |

| Day’s Range | USD 28.90 – USD 31.86 |

| 52-Week Range | USD 11.20 – USD 72.98 |

| Beta | 1.37 |

| Analyst Rating | Buy |

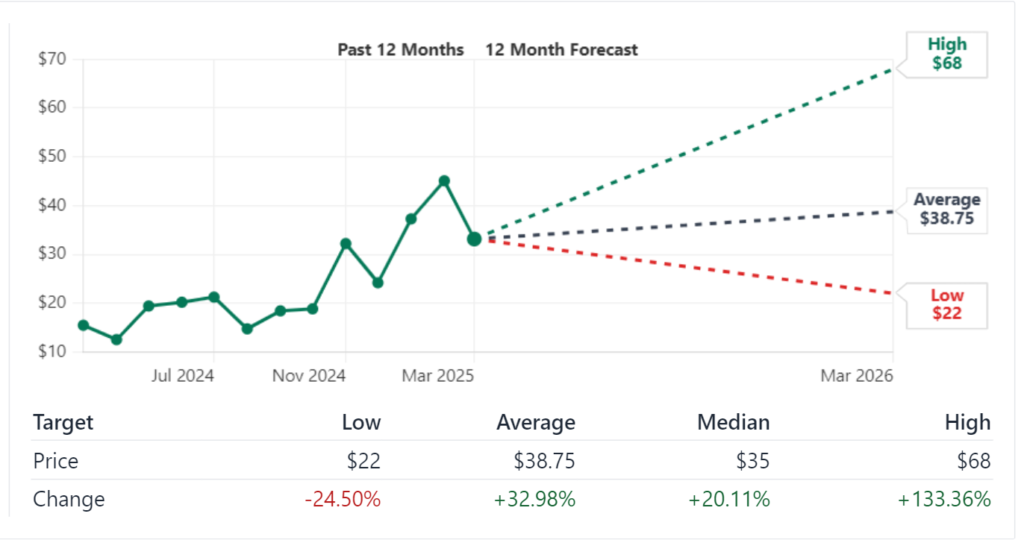

| Price Target | USD 38.75 (approx. 33% increase) |

Market sentiment remains optimistic among analysts, with a consensus rating of “Buy.” The stock has shown resilience during market fluctuations, supported by the company’s rapid revenue expansion and strategic investments in the telehealth sector.

3. Short-Term Price Predictions (2025)

5-Day to 1-Month Forecast

Short-term forecasts for HIMS stock rely on current market trends, technical indicators, and recent trading patterns. Analysts expect that over the next 5 days to 1 month, the stock could experience moderate fluctuations with a slight upward trend. Key factors influencing this period include trading volume, investor sentiment, and earnings announcements scheduled for early May 2025.

A brief table presents the short-term forecast metrics:

| Time Frame | Expected Price Range (USD) | Key Drivers |

|---|---|---|

| Next 5 Days | 28.50 – 30.50 | Trading volume, market reaction to news |

| 1-Week | 28.40 – 30.70 | Earnings preview, volatility in healthcare |

| 1 Month | 28.20 – 31.00 | Analyst upgrades, regulatory announcements |

Drivers Behind the Short-Term Forecast

Several factors contribute to the short-term price forecast for HIMS:

- Earnings Announcements: The upcoming earnings release on May 5, 2025, will likely influence investor sentiment. A positive earnings report could boost the stock price.

- Volume and Liquidity: Trading volumes exceeding 20 million shares per day indicate active market participation. Higher liquidity often supports price stability.

- Market Environment: The overall market sentiment in the healthcare and consumer staples sectors continues to encourage investments in telehealth services.

- Technical Levels: Key support levels around USD 28.90 and resistance near USD 31.86 will guide near-term price movement. Monitoring these technical markers is essential for short-term traders.

4. Long-Term Price Predictions (2025–2030)

Long-term forecasts consider broader market trends, innovation in telehealth, and strategic company developments. The outlook for HIMS stock over the next five years remains promising given its growing revenue base and market expansion.

early Forecast Summary

The following table summarizes the yearly price predictions based on current trends and financial performance:

| Fiscal Year | Forecasted Price (USD) | Percentage Increase (Approx.) |

|---|---|---|

| 2025 | 32.00 – 34.00 | 10-17% over current levels |

| 2026 | 35.00 – 37.00 | 5-10% increase |

| 2027 | 38.00 – 40.00 | 8-12% growth |

| 2028 | 41.00 – 43.00 | 6-10% expansion |

| 2029 | 44.00 – 46.00 | 5-8% growth |

| 2030 | 47.00 – 50.00 | 7-10% increase from 2029 levels |

Long-Term Catalysts

Several catalysts may drive HIMS stock performance in the long term:

- Expansion into New Markets: HIMS continues to grow its customer base internationally. Regulatory approvals and expansion into emerging markets can push revenue higher.

- Technological Innovation: Continued investments in telehealth infrastructure and digital health services will likely improve service efficiency and attract a broader customer base.

- Partnerships & Collaborations: Strategic partnerships with healthcare providers and pharmaceutical companies can enhance product offerings.

- Regulatory Environment: A favorable regulatory landscape for telehealth services supports growth prospects.

- Consumer Trends: Increased adoption of online healthcare services adds to the long-term growth potential.

5. Technical Analysis

Technical analysis provides additional insights into the stock’s potential movements. By evaluating moving averages, momentum indicators, and volatility measures, traders can gain a clearer view of short-term and long-term trends.

Moving Averages

Moving averages smooth out price data and help to identify trends. For HIMS, the 50-day and 200-day moving averages are key:

- 50-Day Moving Average: Currently indicates near-term trend direction. If the stock price remains above this level, it may signal short-term strength.

- 200-Day Moving Average: Acts as a longer-term indicator. A price above the 200-day average generally reflects a healthy trend, while a drop below could raise concerns among investors.

Momentum Indicators

Momentum indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), offer further insights:

- RSI: Values near 70 indicate overbought conditions, while those around 30 suggest oversold scenarios. HIMS has recently maintained balanced RSI levels, suggesting that it is neither overbought nor oversold.

- MACD: When the MACD line crosses above the signal line, it suggests bullish momentum. Current technical charts show mixed signals, warranting close observation during upcoming trading sessions.

Volatility Analysis

Volatility metrics help in understanding price fluctuations:

- Bollinger Bands: These bands expand and contract based on market volatility. A narrow band indicates low volatility, while a wide band suggests increased price fluctuations.

- Beta Value: HIMS has a beta of 1.37, which implies higher volatility compared to the overall market. Investors should consider this when assessing risk.

6. Investment Potential & ROI Scenarios

Investment decisions must weigh both potential rewards and risks. Analysis for HIMS spans multiple time frames to guide investors.

Short-Term Investment: 1 Month

For a one-month investment, the potential return is modest. The expected price range from USD 28.20 to USD 31.00 implies an opportunity for a small percentage gain. Short-term investors may benefit from timely earnings updates and technical support levels. Daily monitoring of technical indicators is recommended.

Medium-Term Investment: 1 Year

Over a one-year horizon, the company’s robust revenue growth and improved operational margins are likely to translate into enhanced stock performance. Analysts forecast a 5–15% increase from current levels. Investors should follow quarterly earnings reports and review updates from industry experts. A diversified portfolio approach helps mitigate risks during periods of market volatility.

Long-Term Investment: 5 Years (2030)

A five-year investment scenario envisions considerable capital appreciation. Projected price targets for 2030 range from USD 47.00 to USD 50.00. Growth drivers include expansion in the telehealth sector, increased adoption of digital health solutions, and the company’s efforts to capture new market segments. A long-term view requires patience and ongoing evaluation of strategic initiatives. Investors should monitor regulatory changes and market dynamics to adjust positions if needed.

The ROI scenarios below provide a simplified view of potential returns:

| Investment Horizon | Initial Price (USD) | Forecasted Price Range (USD) | Estimated ROI |

|---|---|---|---|

| 1 Month | ~29.14 | 28.20 – 31.00 | -3% to +6% |

| 1 Year | ~29.14 | 32.00 – 34.00 | +10% to +17% |

| 5 Years (2030) | ~29.14 | 47.00 – 50.00 | +60% to +72% |

7. Monthly Forecast Breakdown (2025)

A month-by-month forecast for 2025 details expected movements and significant events.

March 2025

- Expected Price Range: USD 28.90 – USD 31.00

- Key Events:

- End-of-month technical consolidation

- High trading volumes as investors review Q1 performance

- Market Focus:

- Monitoring support and resistance levels

- Potential impact of early analyst reports

April 2025

- Expected Price Range: USD 29.00 – USD 31.50

- Key Events:

- Preview of the upcoming earnings report

- Increased media coverage of telehealth market trends

- Market Focus:

- Analysis of macroeconomic indicators

- Observation of sector performance trends

May 2025

- Expected Price Range: USD 30.00 – USD 32.50

- Key Events:

- Earnings release on May 5, 2025

- Investor conference calls and analyst briefings

- Market Focus:

- Reaction to earnings outcomes

- Adjustments in technical support levels

November 2025

- Expected Price Range: USD 31.00 – USD 33.00

- Key Events:

- End-of-year market positioning

- Preparation for Q4 results and year-end reviews

- Market Focus:

- Evaluation of annual performance

- Adjustments in market sentiment ahead of the holiday season

8. Risk Factors & Market Dynamics

A comprehensive forecast must address both external and internal risks.

External Risks

- Market Competition: The telehealth industry remains competitive with established and emerging players. Increased competition could affect market share.

- Regulatory Changes: Shifts in healthcare regulations can impact operational costs and pricing strategies.

- Economic Conditions: Global economic uncertainty may influence consumer spending and investment patterns in healthcare services.

- Technological Disruptions: Rapid changes in technology and cybersecurity threats could affect service delivery and operational continuity.

Internal Risks

- Operational Challenges: Managing rapid growth poses challenges in maintaining service quality and operational efficiency.

- Financial Management: Fluctuations in profit margins and cost control remain important considerations.

- Strategic Execution: The company’s ability to execute long-term strategies, including market expansion and technology upgrades, will impact performance.

9. Historical Performance & Analyst Ratings

Understanding past performance offers context for future forecasts. The historical data and analyst insights help in setting realistic expectations.

Historical Stock Price

HIMS stock has shown a wide range over the past 52 weeks, from a low near USD 11.20 to a high of approximately USD 72.98. The volatility observed in its price history reflects both market uncertainty and the high growth potential within the telehealth sector. Historical charts available on Yahoo Finance provide a visual representation of these price movements.

Analyst Consensus

Analysts maintain a “Buy” consensus on HIMS stock. The average price target of USD 38.75 suggests a significant upside compared to current trading levels. Analyst reports emphasize the company’s strong revenue growth and potential in expanding its market reach. For further details, investors may refer to the detailed analyses available on S&P Global Market Intelligence and Yahoo Finance.

10. Frequently Asked Questions (FAQs)

Q1: What drives HIMS stock performance?

A1: HIMS stock performance is driven by earnings results, trading volume, market sentiment, and regulatory developments. Technical indicators like moving averages and momentum signals also play a role.

Q2: What are the short-term price predictions for HIMS?

A2: Short-term forecasts indicate a price range of USD 28.20 to USD 31.00 over the next month. Earnings announcements and technical levels will influence this range.

Q3: How does HIMS plan to expand its market?

A3: HIMS focuses on expanding its telehealth services internationally, forging new partnerships, and investing in technology upgrades to enhance service delivery.

Q4: What are the key risks investors should monitor?

A4: Investors should consider market competition, regulatory changes, economic conditions, and internal challenges related to operational management and strategic execution.

11. Conclusion

Hims & Hers Health, Inc. presents an interesting investment opportunity within the rapidly growing telehealth sector. The stock shows potential in both the short term and long term. A comprehensive analysis of key metrics, technical factors, and risk elements provides a balanced view of its performance. Short-term forecasts indicate moderate price fluctuations influenced by trading activity and upcoming earnings. Long-term forecasts show an upward trend driven by market expansion and technological innovations.

Investors should note that while the technical analysis and analyst ratings support a “Buy” recommendation, risk management remains essential. The combination of robust revenue growth, favorable market dynamics, and the company’s strategic initiatives provides a promising outlook. Regular monitoring of market data from trusted sources such as Yahoo Finance and S&P Global Market Intelligence is recommended to make informed decisions.

Additional Data – HIMS Financial Summary

Below is a detailed summary of HIMS financial performance from the latest available reports:

| Fiscal Year | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

|---|---|---|---|---|---|

| Revenue (Millions USD) | 1,477 | 872 | 526.92 | 271.88 | 148.76 |

| Revenue Growth (YoY) | 69.33% | 65.49% | 93.81% | 82.77% | 80.19% |

| Cost of Revenue (Millions USD) | 303.38 | 157.05 | 118.19 | 67.38 | 39.31 |

| Gross Profit (Millions USD) | 1,173 | 714.95 | 408.72 | 204.49 | 109.45 |

| Operating Income (Millions USD) | 66 | -26.01 | -66.38 | -106.94 | -15.14 |

| Net Income (Millions USD) | 126.04 | -23.55 | -65.68 | -107.66 | -18.11 |

| EPS (Diluted) | 0.53 | -0.11 | -0.32 | -0.58 | -0.51 |

| Free Cash Flow (Millions USD) | 209.43 | 56.26 | -29.25 | -35.24 | -4.22 |

Final Thoughts

The analytical forecast presented here is designed to provide investors with a clear understanding of HIMS stock performance and potential. By combining technical analysis with fundamental metrics, this report outlines realistic price targets and growth scenarios over the short and long term. Investors are encouraged to supplement this report with ongoing market research and professional advice.

This article is for informational purposes only. Investors should perform their own research before making investment decisions. All data points are based on the latest available financial reports and market analysis as of March 28, 2025.