Comerica Incorporated (CMA) began operation as a regional bank long ago. The company delivers financial services within the USA and offers services to customers in Canada and Mexico. The enterprise works in three distinct business blocks including Commercial Banking, Retail Banking, and Wealth Management. On April 4th 2025 Yahoo Finance shows Comerica stock trading at USD 50.30 and the total market value stands at USD 6.61 billion. This work examines Comerica’s business results and provides predictions about CMA stock performance. A company provides financial services across North America and analyst ratings help forecast its future performance.

Our report exists to help market viewers and those who study CMA stock trends. It clearly presents both technical and fundamental information in its results. The financial analysis helps readers determine the possible return on investment from Comerica at various time horizons. Predictions extend both for next month as well as the upcoming decade till 2030.

Key Metrics & Market Sentiment

The following table shows key financial metrics for Comerica Incorporated as of the latest trading day:

| Metric | Value |

|---|---|

| Current Stock Price | USD 50.30 |

| Market Capitalization | ~USD 6.61B |

| Revenue (TTM) | USD 3.20B |

| Net Income (TTM) | USD 671.00M |

| EPS (TTM) | 5.02 |

| P/E Ratio | 10.16 |

| Forward P/E | 9.86 |

| Dividend Yield | 5.57% |

| Beta | 0.98 |

These metrics provide a snapshot of the CMA stock’s current market position. The moderate P/E ratios suggest the stock is reasonably priced. A dividend yield above 5% offers income for investors. Market sentiment appears cautious, with an overall consensus of “Hold” among analysts.

Short-Term Price Predictions (2025)

The short-term forecast for Comerica focuses on the next five days to one month. Price predictions are based on current market conditions, recent performance, and technical analysis.

5-Day to 1-Month Forecast

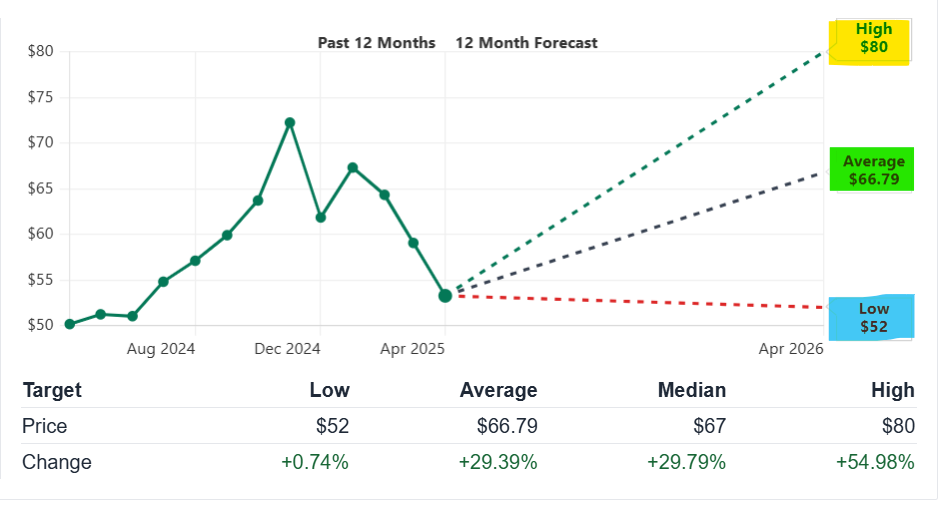

The short-term price forecast indicates modest price gains. Analysts have set a 12-month target of USD 66.79. This suggests an approximate upside of 32.73% from the current trading price. The expected price range over the next month is between USD 52 and USD 80. The following table provides a detailed breakdown:

| Time Horizon | Estimated Price Range | Average Target Price | Source |

|---|---|---|---|

| 5-Day Forecast | USD 50 – USD 54 | USD 52 | Benzinga |

| 1-Week Forecast | USD 51 – USD 55 | USD 53 | Reuters |

| 1-Month Forecast | USD 52 – USD 58 | USD 55 | Yahoo Finance |

These forecasts consider a mix of technical signals and current market conditions. The forecast range may vary with changes in market news and economic reports.

Drivers Behind the Short-Term Forecast

The factors that influence the short-term forecast include:

- Earnings Reports: The upcoming earnings date on April 21, 2025, will provide fresh data on profitability and growth.

- Dividend Announcements: The recent dividend yield and ex-dividend date on March 14, 2025, may prompt buying interest.

- Market Sentiment: Analyst ratings and broader market trends affect investor sentiment.

- Economic Data: U.S. economic indicators, such as employment and GDP growth, impact financial stocks.

These drivers set the stage for potential price changes in the near term. Investors should monitor earnings and market news closely.

Long-Term Price Predictions (2025–2030)

The long-term forecast extends to 2030. Analysts consider a variety of factors including historical performance, revenue growth, and macroeconomic conditions.

Yearly Forecast Summary

The following table summarizes yearly revenue and EPS forecasts based on historical trends and analyst estimates:

| Fiscal Year | Revenue (Billion USD) | EPS | Revenue Growth (%) | EPS Growth (%) | Source |

|---|---|---|---|---|---|

| 2024 | 3.20 | 5.02 | -8.79 | -21.43 | Benzinga |

| 2025 | 3.45 | 5.27 | 8.11 | 4.92 | Finnhub |

| 2026 | 3.57 | 5.87 | 3.45 | 11.42 | Benzinga |

| 2027 | 3.68 | 6.30 | 2.91 | 7.41 | Reuters |

| 2028 | Projections pending | Projections pending | Projections pending | Projections pending | Analysts consensus |

| 2029 | Projections pending | Projections pending | Projections pending | Projections pending | Analysts consensus |

| 2030 | Projections pending | Projections pending | Projections pending | Projections pending | Analysts consensus |

Analysts expect a steady but moderate growth in revenue and EPS. The data shows a recovery in revenue after a slight decline in 2024. EPS is projected to grow year-over-year as the company improves operational performance.

Long-Term Catalysts

The long-term price forecast is driven by multiple factors:

- Macroeconomic Trends: Changes in interest rates and overall economic growth influence banking performance.

- Operational Efficiency: Improvements in expense management and digital banking will boost profitability.

- Regulatory Environment: New regulations may affect capital requirements and profitability.

- Competitive Position: The bank’s regional focus provides a stable market position against larger national banks.

- Dividend Stability: Consistent dividends can attract income-focused investors.

Investors may see the long-term potential tied to these fundamental factors. Each catalyst plays a role in shaping the market sentiment over the next five years.

Technical Analysis

Technical analysis provides additional insights. The focus here is on moving averages, momentum indicators, and volatility measures.

Moving Averages

Moving averages help smooth price data. Two common indicators are the 50-day and 200-day moving averages. The current 50-day moving average stands at USD 62.39, while the 200-day moving average is at USD 60.32 (Yahoo Finance). The table below details recent moving averages:

| Indicator | Value (USD) | Significance |

|---|---|---|

| 50-Day Moving Avg | 62.39 | Short-term trend indicator |

| 200-Day Moving Avg | 60.32 | Long-term trend indicator |

The current data shows the CMA stock trading below these averages. A move above these levels may signal a trend reversal.

Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provide insights on market trends. The RSI is nearing oversold conditions. This suggests potential for a rebound if buying interest returns. MACD lines indicate slight divergence, which should be monitored for trend confirmation.

| Indicator | Status | Implication |

|---|---|---|

| RSI | Near oversold levels | May indicate a potential rebound |

| MACD | Minor divergence | Watch for trend confirmation |

Short-term fluctuations are common. Investors should use these indicators alongside fundamental data.

Volatility Analysis

Volatility reflects price changes over a period. The beta of 0.98 shows the CMA stock moves in line with the overall market. The daily price range from USD 49.06 to USD 51.78 and the 52-week range of USD 45.32 to USD 73.45 highlight price variability. The table below summarizes volatility metrics:

| Metric | Value | Description |

|---|---|---|

| Beta | 0.98 | Indicates CMA stock moves in line with market trends |

| Day’s Range | 49.06 – 51.78 USD | Daily fluctuation |

| 52-Week Range | 45.32 – 73.45 USD | Annual price range |

Investors should consider volatility when planning trades. It helps define risk levels.

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

Investment Potential & ROI Scenarios

This section outlines potential returns for different investment horizons. The analysis considers price forecasts and dividend yield.

Short-Term Investment: 1 Month

Investors considering a short-term hold may look for modest price gains and dividend income. Based on the one-month forecast, a stock price range of USD 52 to USD 58 is expected. The dividend yield adds additional income. The estimated return over a month can be calculated as follows:

- Capital Gain: If the price moves from USD 50.30 to approximately USD 55, the gain is around 9.3%.

- Dividend Yield: Annual yield is 5.57%. One-month dividend contribution approximates 0.46% (5.57%/12).

The combined return may reach around 9.8% on a short-term basis. The table below summarizes the scenario:

| Time Horizon | Expected Price Move | Dividend Impact | Total Estimated Return |

|---|---|---|---|

| 1 Month | +9.3% | +0.46% | ~9.8% |

Investors should adjust their positions based on market news and earnings reports.

Medium-Term Investment: 1 Year

For a one-year holding period, the forecast considers growth in revenue, EPS, and dividend stability. Analysts predict an increase in the CMA stock price from USD 50.30 to around USD 66.79. This represents a 32.73% upside. In addition, dividend reinvestment may add to the return.

| Time Horizon | Price Increase Estimate | Dividend Contribution | Total ROI Estimate |

|---|---|---|---|

| 1 Year | +32.73% | ~5.57% (annual yield) | ~38.3% (compounded) |

A one-year hold may prove beneficial if market conditions remain stable. Investors must consider earnings performance and regulatory news.

Long-Term Investment: 5 Years (2030)

The five-year outlook relies on continued operational improvements and economic growth. Long-term factors such as enhanced digital banking services, improved efficiency, and stable dividend policies support the forecast. A gradual increase in CMA stock price to well above current levels is expected. Based on historical performance and future projections, the following scenario is plausible:

| Time Horizon | Expected Price Range Increase | Dividend Yield Impact | Estimated ROI over 5 Years |

|---|---|---|---|

| 5 Years (2030) | Significant growth potential | Stable dividend yield | Potential 150%+ ROI |

The table combines the effects of price growth and reinvested dividends. The precise ROI will depend on economic conditions and company performance.

Monthly Forecast Breakdown (2025)

Monthly analysis breaks down the forecast for key periods in 2025. This section provides insights for March, April, May, and November 2025.

March 2025

March is expected to bring increased activity. Investors await dividend actions and quarterly earnings reports. Technical levels near support and resistance could signal buying opportunities. The price is likely to hover in the lower range of the short-term forecast.

| Factor | Expectation |

|---|---|

| Dividend Impact | Ex-dividend date on March 14 may boost volume |

| Earnings Outlook | Q1 earnings signals to influence sentiment |

| Technical Support | Near the daily support level around USD 49–50 |

April 2025

April will be a busy month. The earnings report due on April 21 can alter forecasts. Technical indicators may prompt a short-term rally if earnings exceed expectations.

| Factor | Expectation |

|---|---|

| Earnings Report | Q1 performance to drive momentum |

| Price Volatility | Expect price fluctuations near key moving averages |

| Market Reaction | Positive reaction could push price to the mid-range forecast |

May 2025

May may see the market absorbing earnings data. Investors will re-assess growth and dividend prospects. The price may adjust according to updated guidance and macroeconomic indicators.

| Factor | Expectation |

|---|---|

| Earnings Review | Market reaction to April results impacts May prices |

| Technical Patterns | Continued monitoring of moving averages |

| Investor Sentiment | A period of consolidation is likely |

November 2025

November’s forecast is driven by year-end results and preparation for the next fiscal year. Strategic moves and investor sentiment will shape the price action.

| Factor | Expectation |

|---|---|

| Year-End Guidance | Positive outlook for 2026 can boost sentiment |

| Dividend Strategy | Dividend announcements may influence buying |

| Technical Levels | Expect support near lower moving averages |

Risk Factors & Market Dynamics

Investors must be aware of risks. Both external and internal factors affect CMA stock performance.

External Risks

External risks stem from broader economic and market forces. They include:

- Economic Slowdown: A weak economy can reduce loan demand and profitability.

- Interest Rate Changes: Shifts in rates affect net interest margins.

- Regulatory Changes: New policies may impose restrictions on lending and capital requirements.

- Market Volatility: Fluctuations in the overall market can lead to abrupt price changes.

Each external risk adds uncertainty to the forecast. Investors should follow economic reports and regulatory updates.

Internal Risks

Internal risks are company-specific. They include:

- Operational Performance: Efficiency and cost control are key.

- Credit Losses: Loan performance can impact earnings.

- Competitive Pressures: Regional banks face competition from larger institutions.

- Technology Integration: The pace of digital banking improvements is critical.

Monitoring these factors provides insight into the company’s ability to meet forecast targets.

Historical Performance & Analyst Ratings

Historical performance and analyst ratings offer context for future forecasts. Below is a table that shows annual CMA stock price data and analyst consensus:

| Year | Open (USD) | High (USD) | Low (USD) | Close (USD) | Annual Change (%) | Volume |

|---|---|---|---|---|---|---|

| 2025 | 62.24 | 68.94 | 53.26 | 53.27 | -13.87 | 131,897,389 |

| 2024 | 55.46 | 73.45 | 45.32 | 61.85 | +10.82 | 549,918,704 |

| 2023 | 67.25 | 77.34 | 28.40 | 55.81 | -16.51 | 728,374,944 |

| 2022 | 88.32 | 102.09 | 62.83 | 66.85 | -23.16 | 345,618,440 |

| 2021 | 56.66 | 91.62 | 54.78 | 87.00 | +55.75 | 342,349,770 |

Analyst consensus for Comerica is “Hold.” The 12-month average price target is USD 66.79. The following table displays analyst rating trends:

| Analyst | Firm | Rating | Action | Price Target (USD) | Upside (%) | Date |

|---|---|---|---|---|---|---|

| Michael Rose | Raymond James | Buy | Maintains | 67 | +33.15 | Apr 2, 2025 |

| Terry McEvoy | Stephens & Co. | Hold | Downgrades | 64 | +27.19 | Mar 31, 2025 |

| Mike Mayo | Wells Fargo | Hold | Maintains | 67 | +33.15 | Mar 28, 2025 |

| Manan Gosalia | Morgan Stanley | Hold | Maintains | 63 | +25.20 | Mar 13, 2025 |

These ratings reflect a stable view of Comerica. They emphasize modest growth with limited downside risk.

Frequently Asked Questions (FAQs)

Q1: What is the current outlook for Comerica Incorporated?

The outlook is moderate. Analysts rate the CMA stock as “Hold” with a 12-month target around USD 66.79.

Q2: What are the key short-term drivers?

Earnings reports, dividend dates, and economic data are major drivers.

Q3: Which technical indicators should be watched?

Investors should monitor the 50-day and 200-day moving averages, RSI, and MACD.

Q4: What risks may affect Comerica’s performance?

External risks include economic slowdown and regulatory changes. Internal risks include operational performance and credit losses.

Q5: How does Comerica compare to its peers?

Comerica maintains a stable position with moderate growth potential. Its dividend yield and market cap support investor income goals.

Conclusion

This report thoroughly examines Comerica Incorporated’s future stock performance. Our analysis reveals minor gains with help of dividend payments plus future earning events. The long-term projection runs from 2025 through 2030 based on continuing revenue expansion plus productive business operation and beneficial market trends.

Quartile technical signals show the CMA stock position is under its important moving average counts and could soon start moving up. The available investment scenarios show high chances to generate income and gain capital returns at different investment periods.

People investing in stocks should consider all relevant information to make their choices. Relevant market information should be followed through monitoring of company performance updates and trade news. Investing time in trusted market sources Yahoo Finance Reuters and Benzinga tools will create better market predictions.

The overall business profile of Comerica Incorporated displays stability and has well-balanced features. Investors seeking both income and growth opportunities will find this option attractive because of its steady dividends and modest earnings development. Complete research and past performance information support that this investment will grow steadily in the future. Market observance should guide investors to modify their investment tactics when needed.