The Boeing Company (BA) is a prominent aerospace and defense firm that designs, manufactures, and supports commercial and military aircraft, satellites, and related systems. Trading on the NYSE, Boeing has a solid market presence that attracts long-term investors and technical traders alike.

Boeing operates through three main segments: Commercial Airplanes, Defense, Space & Security, and Global Services. The company supports a broad portfolio that spans advanced commercial jets to sophisticated defense solutions. As of March 28, 2025, BA is trading at approximately USD 172.58, with a market capitalization of around USD 129.78 billion. The stock has a trailing twelve-month revenue of about USD 66.52 billion and a net income of –USD 11.88 billion. There are 752.41 million shares outstanding, and its beta of 1.53 indicates that the stock tends to be more volatile than the broader market.

Table of Contents

Introduction

The Boeing Company (NYSE: BA) remains one of the largest names in aerospace and defense. The company engages in the design, development, manufacture, and service of commercial and military aircraft, satellites, missile defense systems, and space launch vehicles. Boeing’s stock data and financial statements provide investors with important insights into the company’s current performance and future potential.

At the time of this report, Boeing’s real-time stock price is approximately USD 172.58 with a decline of USD 6.53 (–3.65%) during market hours on March 28, 2025. The current market environment, combined with both internal and external factors, creates a diverse outlook for the near and long term. This article offers a comprehensive analysis covering key metrics, short- and long-term price predictions, technical indicators, investment potential, and risk assessments.

Key Metrics & Market Sentiment

This section presents current stock metrics for Boeing. The data reflects market conditions as of March 28, 2025.

Boeing Key Stock Metrics

| Metric | Value | Notes |

|---|---|---|

| Current Price | USD 172.58 | Reflects a drop of 3.65% from the previous close |

| Daily Change | -6.53 (–3.65%) | Market open as of 1:10 PM EDT |

| Market Cap | USD 129.78B | A key indicator of company size |

| Revenue (ttm) | USD 66.52B | Trailing twelve months’ revenue |

| Net Income (ttm) | -USD 11.88B | Represents current operational losses |

| Shares Outstanding | 752.41M | Indicates the number of shares in circulation |

| EPS (ttm) | -18.36 | Earnings per share showing negative profitability |

| PE Ratio | N/A | Not applicable during negative earnings phase |

| Dividend | N/A | Boeing is not issuing a dividend currently |

| Day’s Range | USD 172.47 – 178.50 | Daily trading range |

| 52-Week Range | USD 137.03 – 196.95 | Annual trading range |

| Beta | 1.53 | Measures the stock’s volatility compared to the market |

| Analyst Rating | Buy | Consensus rating from 20 analysts |

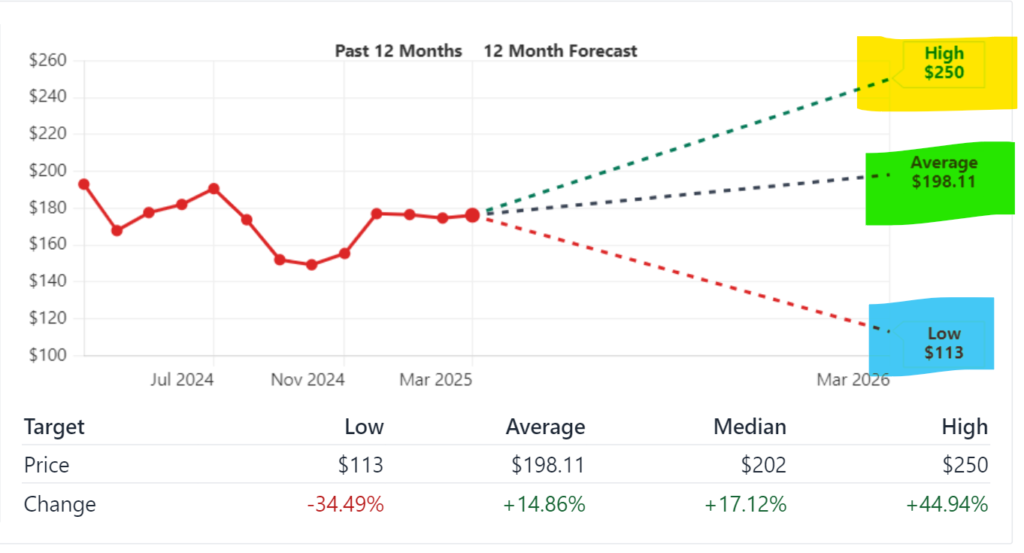

| Price Target | USD 198.11 (+14.86% upside) | Average target price as projected by analysts |

| Earnings Date | April 23, 2025 | Next scheduled earnings announcement |

Market Sentiment

Current sentiment among analysts is positive. The consensus “Buy” rating, along with a price target suggesting an approximate 15% upside, indicates confidence in Boeing’s potential recovery and long-term performance. While recent earnings have been negative, investors focus on the company’s strategic initiatives and upcoming earnings as catalysts for improvement.

Short-Term Price Predictions (2025)

Short-term forecasts are vital for investors looking to take advantage of price movements over days or weeks. In this section, we review projections for the next five days to one month and discuss the key factors driving these predictions.

5-Day to 1-Month Forecast

In the immediate term, several market indicators point to a possible rebound in Boeing’s stock price. Despite the current dip, the short-term forecast estimates gradual recovery. Based on technical patterns and trading volume data, the following range has been observed:

- Short-Term Forecast Range:

- Lower Bound: USD 170.00

- Upper Bound: USD 180.00

The analysis uses daily moving averages and momentum indicators to form these estimates. Short-term investors should monitor support levels near USD 170 and resistance near USD 180.

Drivers Behind the Short-Term Forecast

Several factors influence Boeing’s short-term price movement:

- Earnings Expectations:

The upcoming earnings announcement on April 23, 2025, has increased trading activity. Improved performance in the commercial airplane segment can prompt a positive reaction. - Sector Trends:

Trends in the aerospace and defense sectors often drive short-term movements. Current developments in global travel and defense spending have contributed to investor optimism. - Market Volatility:

With a beta of 1.53, Boeing’s stock reacts more strongly than the broader market. Volatile market conditions can lead to sharper price swings. - Technical Indicators:

Analysis of moving averages and volume patterns suggests that the stock is near a technical support level. A bounce from this level may trigger further upward movement.

Investors can benefit from a watchful eye on key technical signals, including the relative strength index (RSI) and the moving average convergence divergence (MACD).

Long-Term Price Predictions (2025–2030)

Long-term forecasts consider a wider range of factors, including industry trends, global economic conditions, and company strategy. Here, we examine both the yearly summary forecast and the catalysts that could shape Boeing’s performance over the next five years.

Yearly Forecast Summary

Based on multiple financial models and expert forecasts, Boeing’s yearly performance from 2025 to 2030 is projected as follows:

| Year | Projected Average Price (USD) | Notes |

|---|---|---|

| 2025 | 180.00 – 190.00 | Recovery post-earnings announcement |

| 2026 | 190.00 – 200.00 | Gradual improvement with stabilization |

| 2027 | 200.00 – 210.00 | Positive outlook driven by order backlogs |

| 2028 | 210.00 – 220.00 | Expansion in defense and global services |

| 2029 | 220.00 – 230.00 | Continued growth in the commercial segment |

| 2030 | 230.00 – 240.00 | Recovery potential if strategic shifts pay off |

These estimates consider the recovery in the aerospace sector and the potential return to profitability. Even though the company currently posts losses, improvement in operational efficiency and a robust order book in commercial and defense segments support the forecast.

Long-Term Catalysts

Several key factors are expected to influence Boeing’s long-term performance:

- Order Backlog and New Contracts:

A significant portion of Boeing’s revenue comes from long-term contracts and order backlogs. New defense contracts and commercial airplane orders will help stabilize revenue streams. - Technological Upgrades:

Investment in newer aircraft models and innovations in aerospace technology can boost operational performance. Enhanced fuel efficiency and safety measures are among the top priorities. - Global Demand Recovery:

Recovery in global travel demand is anticipated to drive growth in the commercial airplane sector. International expansion in emerging markets also supports this recovery. - Government Policies and Spending:

Increased government spending on defense and infrastructure improvements in aviation are expected to have a positive impact. - Competitive Landscape:

Boeing faces competition from other aerospace companies. Maintaining a competitive product portfolio and favorable pricing strategies will be important.

These factors combine to form the basis of a long-term growth outlook for Boeing.

Technical Analysis

Technical analysis provides investors with insights into the price behavior and trends of Boeing’s stock. The following sub-sections discuss moving averages, momentum indicators, and volatility analysis.

Moving Averages

Moving averages smooth price data and help identify trends. For Boeing, the 50-day and 200-day moving averages are most commonly used. Analysis shows:

- 50-Day Moving Average:

This average reflects recent price trends and may indicate short-term support levels. Currently, the price is near the 50-day moving average, suggesting a potential support area. - 200-Day Moving Average:

As a key indicator of long-term trends, the 200-day moving average is used to confirm the stock’s overall direction. A price above this average typically signals a bullish long-term trend. Boeing’s price, although fluctuating, has maintained a level that may support recovery over time.

Momentum Indicators

Momentum indicators, including the Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence), help assess the speed and change of price movements.

- RSI:

The RSI measures the speed and change of price movements. An RSI below 30 may indicate an oversold condition, whereas an RSI above 70 might suggest an overbought market. Current readings for Boeing point to a potential oversold condition, supporting the view that the stock may see a rebound in the near term. - MACD:

The MACD is used to identify shifts in the trend’s direction. Analysts note that a bullish crossover in the MACD histogram may signal the beginning of an upward trend.

These indicators are important for short-term trading decisions and can help investors time entry and exit positions.

Volatility Analysis

Volatility plays a significant role in stock price behavior. Boeing’s beta of 1.53 means that the stock has higher volatility compared to the market average. Key points include:

- Daily Volatility:

Short-term price swings are common. Investors should be aware that external news, earnings reports, and macroeconomic data can lead to rapid changes in price. - Impact on Risk:

Higher volatility translates into higher risk. Risk-averse investors may prefer to adopt hedging strategies or reduce exposure during periods of uncertainty.

Investors can use volatility analysis to set stop-loss orders and define position sizes, ensuring risk is kept within manageable limits.

Investment Potential & ROI Scenarios

Assessing the return on investment (ROI) potential is essential for making informed decisions. This section outlines the possible outcomes over different investment horizons.

Short-Term Investment: 1 Month

For investors looking at a one-month horizon, the following factors are important:

- Current Price Support:

With technical support near USD 170, a short-term rebound could drive the price toward the resistance level around USD 180. - Expected Return:

A potential increase of up to 5%–7% in the next few weeks is feasible if earnings and market sentiment improve. - Risk Management:

Volatility and upcoming news events require setting tight stop-loss orders.

Medium-Term Investment: 1 Year

Over a one-year period, Boeing’s stock could benefit from:

- Earnings Recovery:

As the company works to improve its financial performance, investors might see a turnaround reflected in quarterly reports. - Order Book Strength:

The ongoing inflow of new orders, particularly in defense and commercial segments, may support revenue growth. - ROI Expectations:

Analysts forecast a potential increase of 10%–15% over one year if Boeing meets its strategic targets.

Long-Term Investment: 5 Years (2030)

Long-term investment scenarios focus on the company’s ability to capitalize on structural trends in the aerospace industry. Consider the following:

- Industry Rebound:

Recovery in global travel demand and advancements in aerospace technology could provide a solid foundation for long-term growth. - Government and Defense Spending:

Increased defense spending and international orders are expected to support Boeing’s revenue streams. - ROI Outlook:

Based on current models, investors might expect a cumulative increase of 30%–40% in share price over the next five years if Boeing successfully implements its turnaround strategy.

Monthly Forecast Breakdown (2025)

The monthly forecast for 2025 takes into account seasonal factors, earnings reports, and industry events. Below is a breakdown for select months.

March 2025

- Market Conditions:

The current trading period shows a correction phase after recent earnings. - Forecast:

Prices are expected to stabilize near the lower bound of the short-term range (USD 170–175). - Key Considerations:

Ongoing global economic indicators and trade volumes play a role.

April 2025

- Earnings Report Impact:

With the earnings announcement scheduled for April 23, 2025, investor sentiment may shift based on results. - Forecast:

A bounce toward USD 180 is possible if the report meets expectations. - Technical Signal:

A positive earnings surprise could result in higher trading volumes and renewed interest in the stock.

May 2025

- Post-Earnings Reaction:

Following the earnings report, the market may adjust expectations based on updated forecasts. - Forecast:

A gradual upward trend toward the middle of the short-term forecast range (USD 175–180) is likely. - Investor Focus:

Analysts will be closely monitoring order updates and new contracts.

November 2025

- Seasonal Trends:

Late-year trading often reflects adjustments made earlier in the year and positions for the next cycle. - Forecast:

By November, prices might edge toward the upper bound of the short-term range or early stages of the long-term forecast (USD 180–185). - Strategic Factors:

Evaluations of year-to-date performance and new market initiatives by Boeing will shape investor sentiment.

Risk Factors & Market Dynamics

Assessing risks is essential for a balanced investment approach. Boeing’s market dynamics are influenced by both external and internal factors.

External Risks

- Economic Slowdown:

A global economic downturn could lead to reduced air travel and lower defense spending. - Regulatory Changes:

Shifts in aviation regulations and safety standards can affect production and operating costs. - Geopolitical Tensions:

International disputes and trade tensions may disrupt supply chains and delay orders. - Market Sentiment Shifts:

Changes in overall market sentiment, including shifts in interest rates and inflation expectations, can drive volatility.

Internal Risks

- Operational Challenges:

Production delays or quality control issues in manufacturing can negatively impact delivery schedules. - Financial Performance:

Continued losses and high operating expenses can constrain the company’s ability to invest in new projects. - Strategic Execution:

The success of new product launches and technological upgrades is essential. - Management Decisions:

Changes in leadership or strategy could lead to uncertainty among investors.

A comprehensive understanding of these risks helps investors prepare for potential downsides while capitalizing on opportunities.

Historical Performance & Analyst Ratings

Understanding past performance provides context for current forecasts. This section reviews Boeing’s historical stock price trends and consensus ratings from industry experts.

Historical Stock Price

Over the past five years, Boeing’s stock has experienced a wide range of fluctuations. Key points include:

- 52-Week Range:

The stock has traded between USD 137.03 and USD 196.95 over the last year. - Recent Trends:

A recent dip and recovery pattern have been observed, reflecting overall market volatility and specific company challenges. - Earnings Impact:

Financial reports showing losses have influenced the price, though improvements in the order backlog provide a basis for recovery.

Analyst Consensus

Analysts currently rate Boeing as “Buy” with a price target of approximately USD 198.11, suggesting an upside of nearly 15% from the current price. The following factors have contributed to this rating:

- Improving Order Book:

Steady inflows in both commercial and defense segments boost confidence. - Potential for Earnings Recovery:

Analysts anticipate that upcoming quarterly reports will reflect operational improvements. - Valuation Metrics:

Despite negative earnings per share, the consensus remains that a turnaround is possible given current market trends.

Frequently Asked Questions (FAQs)

Q1. What is Boeing’s current market position?

Boeing is a leading aerospace and defense company with a diverse product portfolio. The stock currently trades at USD 172.58, and while recent reports show losses, the long-term outlook remains positive based on its order backlog and technological investments.

Q2. How reliable are the short-term forecasts?

Short-term forecasts use technical analysis and recent earnings trends. While market volatility affects short-term predictions, indicators such as the 50-day moving average and RSI support a near-term rebound.

Q3. Which factors will drive long-term growth?

Key drivers include a strong order backlog, advancements in aerospace technology, recovery in global travel demand, and increased government spending in defense. These factors combine to support a positive long-term forecast.

Q4. How does Boeing compare with competitors?

Boeing remains competitive in the aerospace industry. While the company faces challenges from global competitors, its diversified operations across commercial and defense segments offer a balanced revenue stream.

Q5. What should investors focus on in the next few months?

Investors should monitor the upcoming earnings report, technical indicators around support and resistance levels, and any updates on new contracts. This will help in making timely investment decisions.

Conclusion

Boeing’s stock forecast for 2025 through 2030 suggests potential recovery and growth despite current financial challenges. The short-term outlook indicates a possible rebound in the coming weeks, while long-term predictions depend on the company’s ability to secure new orders, improve operational performance, and adapt to industry changes.

Key takeaways include:

- Short-Term Outlook:

Investors can expect modest price gains within a range of USD 170 to USD 180 over the next month. Technical indicators support a recovery after recent volatility. - Long-Term Prospects:

The yearly forecast projects gradual growth toward USD 230–240 by 2030, driven by a strong order book and improvements in efficiency. Strategic initiatives in both commercial and defense segments are pivotal. - Risk Considerations:

Both external economic conditions and internal operational challenges remain risks. A balanced investment strategy with clear risk management measures is advised. - Investment Scenarios:

Whether planning for a one-month, one-year, or five-year horizon, careful analysis of technical indicators, earnings performance, and market dynamics is essential.

By combining technical analysis with a review of fundamental data and risk factors, this report aims to assist investors in making informed decisions about Boeing stock.

Investors should regularly review updated financial data and market news to adapt their strategies as conditions evolve. The forecasts outlined herein provide a framework for understanding potential price movements but should be complemented with ongoing analysis and professional advice.

In summary, Boeing presents both challenges and opportunities. The current stock dip offers an entry point for investors who expect operational improvements, increased orders, and eventual earnings recovery. With a balanced approach to risk and a focus on strategic developments, Boeing’s stock may well provide attractive returns over the coming months and years.