If you are researching Deere & Company (DE) for a stock price forecast, you have come to the right place. This article presents an analytical review of DE stock for the next few years. Here, we examine key financial indicators, technical signals, and analyst opinions. We also assess short- and long-term price predictions for 2025 through 2030. The report is intended to assist investors in making informed decisions based on reliable data and expert commentary.

Table of Contents

Deere & Company, known for its robust presence in agricultural and heavy construction machinery, has a rich history dating back to 1837. With operations spanning multiple segments—including production and precision agriculture, small agriculture and turf, construction and forestry, and financial services—the company plays an essential role in the global equipment manufacturing sector.

Key Metrics & Market Sentiment

At the current close, Deere trades at around $470.90 with a market capitalization of approximately $127.81 billion. Key financial metrics include:

- Revenue (ttm): $47.86 billion

- Net Income (ttm): $6.22 billion

- EPS (ttm): 22.61

- PE Ratio: 20.82

- Dividend: $6.48 per share (yield: 1.38%)

- 52-Week Range: $340.20 to $515.05

- Beta: 1.01

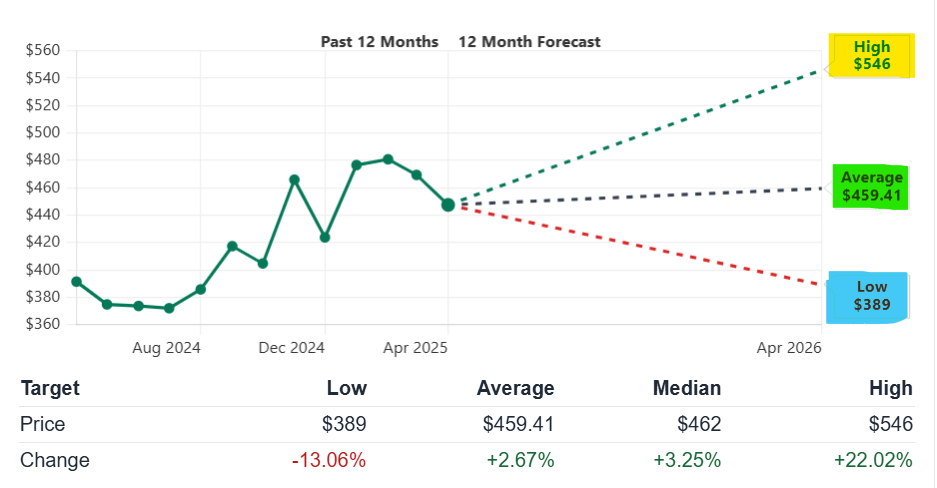

Market sentiment is mixed. Analysts have offered a consensus “Buy” or “Hold” rating. Some forecast slight declines in price, while others maintain a moderate buy rating with an average price target near $459.41. Recent commentary shows that although short-term headwinds exist due to sales pressure and seasonal factors, investor confidence remains cautiously optimistic for the long-term cycle.

Short-Term Price Predictions (2025)

5-Day to 1-Month Forecast

Over the next few days and weeks, technical signals indicate a trading range centered around current support and resistance levels. For instance:

- Current Price: ~$470.90

- Support Level (S1): ~ $466.22

- Resistance Level (R1): ~ $476.56

Based on various technical tools and short-term analyst forecasts, Deere is predicted to see minor fluctuations. One forecast suggests that within the next five days, the price might oscillate between $464 and $480. In a one-month period, the stock may experience a modest gain or loss, depending on market volume and intraday volatility.

Drivers Behind the Short-Term Forecast

Key short-term drivers include:

- Seasonal Demand: The planting and early harvest cycles in agriculture influence equipment orders.

- Inventory Adjustments: Dealer destocking is expected to stabilize soon, affecting price movements.

- Economic Data: Recent reports on interest rates and market liquidity play a role in short-term volatility.

- Technical Signals: Moving averages and Fibonacci retracement levels provide clear support and resistance indicators.

For example, one technical analysis indicates an expected opening near $470.77 with a possible intraday range of ±$12.26, equating to roughly a 2.60% swing. This aligns with the short-term forecasts from several analytical models.

Long-Term Price Predictions (2025–2030)

Yearly Forecast Summary

Long-term forecasts suggest a cyclical recovery for Deere stock. Analysts project that as market conditions improve, particularly in agricultural demand and technological integration in machinery, the stock will see moderate gains over the coming years.

Below is a summary table based on various analyst reports:

| Year | Forecasted Average Price (USD) | Analyst Consensus | Estimated Upside/Downside |

|---|---|---|---|

| 2025 | ~$459 – $475 | Hold/Buy | -2% to +2% |

| 2026 | ~$485 – $500 | Moderate Buy | +3% to +5% |

| 2027 | ~$510 – $525 | Moderate Buy | +5% to +8% |

| 2028 | ~$540 – $560 | Buy | +8% to +12% |

| 2029 | ~$570 – $590 | Buy | +10% to +15% |

| 2030 | ~$600 – $615 | Buy | +12% to +15% |

Note: The figures represent average price targets from select analyst forecasts.

Long-Term Catalysts

Several factors could drive the long-term appreciation of DE stock:

- Technological Integration: Investments in autonomous equipment and subscription-based models are expected to contribute to recurring revenue streams.

- Global Demand Recovery: A rebound in global farm income and stabilization in commodity prices could improve equipment sales.

- Operational Efficiency: Cost-cutting measures and improved dealer inventory management may enhance profit margins.

- Strategic Growth Initiatives: Expansion into new markets and enhanced digital services can boost overall performance.

- Economic Cycles: As cyclical trends reverse, the stock is expected to trade at more attractive multiples.

Analysts have noted that while near-term earnings may remain subdued, fiscal improvements and innovation could drive steady recovery starting in 2026.

Technical Analysis

A comprehensive technical analysis is essential for short- and medium-term forecasting. Here, we assess moving averages, momentum indicators, and volatility.

Moving Averages

Simple Moving Averages (SMA):

| Period | Value (USD) | Signal |

|---|---|---|

| 5-Day | ~477.57 | Sell |

| 50-Day | ~477.57 | Neutral/Resistance |

| 200-Day | ~419.39 | Buy |

Short-term moving averages indicate resistance around current levels. However, the 200-day SMA suggests that the stock remains undervalued over longer periods.

Exponential Moving Averages (EMA):

| Period | Value (USD) | Signal |

|---|---|---|

| 10-Day | ~476.37 | Sell |

| 100-Day | ~455.82 | Buy |

| 200-Day | ~433.85 | Buy |

The faster-reacting EMA shows selling pressure in the short term, but longer-period EMAs point to a potential rebound.

Momentum Indicators

Indicators such as the Relative Strength Index (RSI) and Stochastic Oscillator provide insights into buying or selling conditions:

- RSI (14): Currently near 47, which suggests that the stock is not overbought or oversold.

- MACD: Some analyses have shown a bearish crossover in the short term, though near-term corrections could trigger a reversal.

- Stochastic Oscillator: Values indicate a balanced state with no extreme conditions.

These momentum indicators suggest that while current sentiment is mixed, the underlying trend remains steady, paving the way for possible upward corrections.

Volatility Analysis

The Average True Range (ATR) is a measure of volatility:

- 14-Day ATR: Suggests a daily price swing of about ±$12.26, equating to approximately 2.60% volatility.

- Volume Analysis: Recent volume spikes on down days hint at cautious trading, though the overall liquidity remains strong.

Volatility remains moderate, and controlled price movements are expected given the stock’s stable fundamentals.

Investment Potential & ROI Scenarios

Evaluating Deere’s investment potential requires comparing returns over different horizons.

Short-Term Investment: 1 Month

Investors considering a one-month trade may experience returns in the range of 1% to 2%, based on the projected narrow trading range. A moderate move, either to support or near resistance levels, is anticipated.

Scenario Example:

- Buy Price: ~$470.90

- 1-Month Target: ~$478

- Estimated ROI: Approximately +1.5%

Medium-Term Investment: 1 Year

Over a one-year period, the cyclical nature of the business and gradual market recovery could yield higher returns. Analyst forecasts and the trend in technological investments support moderate gains.

Scenario Example:

- Buy Price: ~$470.90

- 1-Year Target: ~$500

- Estimated ROI: Roughly +6%

Long-Term Investment: 5 Years (2030)

Long-term investors may benefit from cyclical recovery, technological adoption, and improved operating margins. Price targets for 2030 indicate a significant uplift compared to current levels.

Scenario Example:

- Buy Price: ~$470.90

- 5-Year Target: ~$600–$615 (Average ~$607)

- Estimated ROI: Approximately +29%

Table below summarizes the potential ROI scenarios:

| Investment Horizon | Buy Price (USD) | Target Price (USD) | Approximate ROI (%) |

|---|---|---|---|

| 1 Month | 470.90 | 478.00 | +1.5 |

| 1 Year | 470.90 | 500.00 | +6 |

| 5 Years (2030) | 470.90 | 607.00 | +29 |

These scenarios are estimates based on various analyst targets and market conditions.

Monthly Forecast Breakdown (2025)

Below is a monthly breakdown for selected months in 2025, which provides insight into expected price ranges and potential percentage changes.

March 2025

- Expected Price Range: Approximately $465 – $480

- Key Drivers: Seasonal agricultural demand, dealer inventory adjustments, early technical bounce from support levels.

April 2025

- Expected Price Range: Approximately $468 – $483

- Key Drivers: Increased volume from early planting cycles and resolution of short-term supply issues.

- Predicted Fair Opening Price: ~$470.77

May 2025

- Expected Price Range: Approximately $460 – $490

- Key Drivers: Continuation of seasonal trends and potential market corrections.

- Estimated ROI (Monthly): May might witness a slight contraction as inventory levels balance out.

November 2025

- Expected Price Range: Approximately $490 – $510

- Key Drivers: Post-harvest normalization and improved dealer activity.

- Investor Sentiment: Analysts expect improved margins during this period, supporting modest gains.

The following table summarizes these monthly forecasts:

| Month | Expected Range (USD) | Key Drivers | Notes |

|---|---|---|---|

| March 2025 | 465 – 480 | Seasonal demand, inventory adjustments | Early bounce from support |

| April 2025 | 468 – 483 | Increased volume, technical support | Predicted open ~$470.77 |

| May 2025 | 460 – 490 | Seasonal trends, market correction | Slight contraction expected |

| November 2025 | 490 – 510 | Post-harvest normalization, improved margins | Modest gains anticipated |

Risk Factors & Market Dynamics

Investing in DE stock comes with risks that must be carefully considered. These risks are divided into external and internal categories.

External Risks

- Macroeconomic Uncertainty: Changes in interest rates, inflation, and geopolitical events can impact farm incomes and capital spending.

- Commodity Price Fluctuations: Lower agricultural commodity prices reduce farmers’ income, which in turn can depress demand for heavy machinery.

- Trade Policies and Tariffs: Trade disputes or tariffs on steel and aluminum can raise production costs and compress margins citeturn0news22.

- Weather Variability: Severe weather conditions can disrupt farming activities and delay equipment purchases.

Internal Risks

- Inventory Management: High dealer inventory levels may slow down the recovery in equipment sales.

- Segment Performance: Weak performance in key segments such as Construction & Forestry or Small Agriculture & Turf could hamper overall profitability.

- Technological Transition: Shifts to subscription and autonomous models require successful integration and market acceptance.

- Cost Pressures: Rising input costs and potential inefficiencies in operations may challenge profitability.

Investors must weigh these risks against the potential for cyclical recovery and operational improvements.

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

Historical Performance & Analyst Ratings

Historical Stock Price

Deere & Company has a long history of performance that reflects both the cyclical nature of the agricultural equipment market and periods of growth driven by innovation. Historical data shows:

- 52-Week High: $515.05

- 52-Week Low: $340.20

- Recent Trend: The stock has experienced fluctuations consistent with seasonal cycles and broader market trends. Despite near-term declines, the overall long-term performance remains robust.

Analyst Consensus

Analyst ratings for Deere are mixed yet cautiously optimistic:

- Consensus Rating: “Buy” or “Hold” among many analysts.

- Price Targets: Average targets range from $459 to $487, with some variations.

- Rating Breakdown: A mix of Strong Buy, Buy, and Hold ratings is seen. For example, one source notes an average price target of $476.53 with a slight upside, while other reports emphasize a moderate buy rating with expectations for cyclical recovery.

The following table provides a snapshot of analyst ratings:

| Analyst Source | Consensus Rating | Average Price Target (USD) | Upside/Downside Estimate |

|---|---|---|---|

| StockAnalysis.com | Buy | $459.41 | -2.44% |

| Zacks (via Fintel) | Hold | $476.53 | +1.89% |

| TradingView | Neutral/Sell | $498.53 | Variable |

| Public.com | Hold | $341.28* | 0% change (in one forecast) |

*Note: Some sources may offer differing forecasts due to differing methodologies.

Frequently Asked Questions (FAQs)

Q1: What is the current price of DE stock?

As of the close on April 02, 2025, Deere is trading at approximately $470.90.

Q2: What are the key short-term support and resistance levels?

Technical analysis indicates support near $466.22 and resistance around $476.56

Q3: What is the analyst consensus rating for Deere?

The ratings vary by source, with many analysts giving a “Buy” or “Hold” recommendation. Some reports suggest a consensus rating around “Buy” with a price target near $459–$476.

Q4: What are the long-term price predictions for Deere?

Long-term forecasts for 2030 predict an average price in the range of $600–$615, with year-by-year improvement as market conditions normalize.

Q5: Which factors will drive DE’s future performance?

Future performance will depend on technological innovations, global agricultural income trends, operational improvements, and the ability to manage dealer inventories efficiently

Q6: What are the main risks associated with investing in DE stock?

Risks include macroeconomic uncertainties, commodity price fluctuations, trade policy changes, weather variability, and internal challenges such as high inventory levels and cost pressures.

Q7: When is the next earnings announcement?

The upcoming earnings date for Deere & Company is May 15, 2025

Conclusion

The Deere & Company stock forecast shows three different parts of performance: its repeating cycles plus buy and sell indicators alongside its market potential. Expect small market movements in next periods with support at $466.22 and resistance at $476.56. The company faces mixed short-term market signals but remains positive during the long-term about the return to normal agricultural demand plus new technology breakthroughs.

Experts closely evaluate Cargill yet they mostly recommend limiting stock buying or keeping it with space between $459 and $487 over the upcoming months. Their range of predictions grows past $487 when market recovery takes hold. Investors need to weigh the balanced risks from market and company factors against the expected return to recovery.

Exceptionally short investments may deliver small returns but capital growth over multiple years gives better chances of substantial gains. Throughout market recovery and strong conditions DE stock should grow by 29% over five years to reach its estimated target price of $607. Investors need to follow how seasonal patterns impact business results as market sentiments change plus watch farm conditions that influence company gains.

Despite current mixed market signals and short-term problems Deere & Company stands ready to thrive when market cycles recover. Investors should watch DE stock movement before acquisition by checking vital price points alongside expert reports and diversifying their investments carefully.

Investors see uncertainty as part of every price forecast they use. Contact your financial advisor and do more research before investing in this opportunity.