This research examines The Boston Beer Company (NYSE: SAM) through a detailed examination of its future market performance over different timeframes. Our analysis involves reviewing multiple data types including essential financial measures, market feelings, trading chart data, and possible purchase opportunities. Our up-to-date review in April 2025 depends on official resources to guide investors toward right investment choices.

The Boston Beer Company leads American production of alcoholic beverages as an established enterprise. The Boston Beer Company serves different consumer groups through its product line which includes Samuel Adams, Twisted Tea, Truly, and Angry Orchard. The company receives praise for its brewing creativity and maintains solid market engagement. This analysis looks at SAM stock prediction for coming years and future market performance.

Table of Contents

Our analysis evaluates SAM stock based on both financial numbers and market trend data. The report provides estimated prices for 2025 before sharing how the business plans to develop over the next ten years. Our thorough evaluation helps investors understand SAM’s future growth potential based on official and recent financial information.

Key Metrics & Market Sentiment

The current trading data for SAM reflects both solid fundamentals and market fluctuations. As of the close on April 2, 2025, the stock traded at $246.36. In pre-market trading on April 3, 2025, the price was recorded at $242.01. Key financial metrics are summarized in the table below.

| Metric | Value |

|---|---|

| Market Capitalization | $2.73 Billion |

| Revenue (ttm) | $2.01 Billion |

| Net Income (ttm) | $59.56 Million |

| EPS (ttm) | 5.06 |

| P/E Ratio | 48.67 |

| Forward P/E | 24.92 |

| Dividend | n/a |

| 52-Week Range | $215.10 – $339.77 |

| Beta | 1.26 |

| Analyst Rating | Hold |

| Price Target | $289.44 (17.49% upside) |

| Earnings Date | April 24, 2025 |

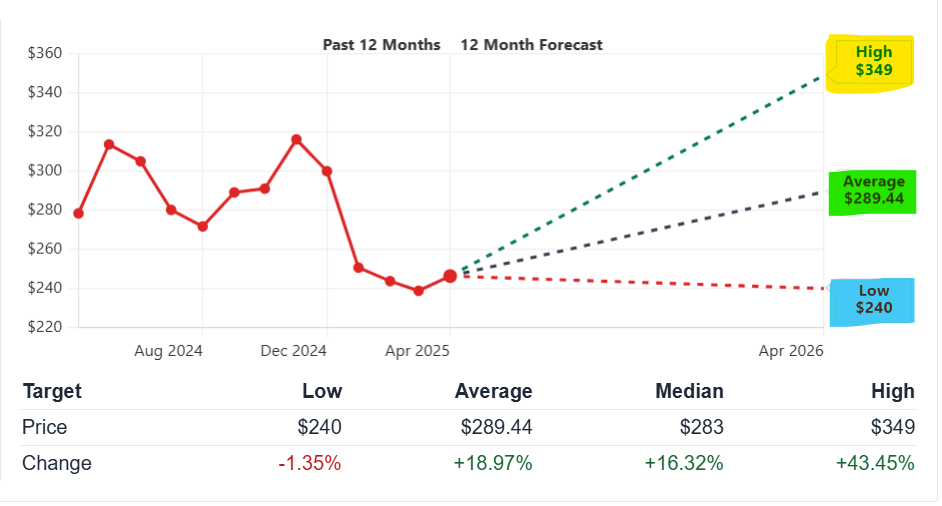

Market sentiment remains cautious despite a recent gain of 1.19% during regular trading hours. Analysts maintain a “Hold” rating with a price target of $289.44, suggesting a potential increase of approximately 17.5%. Investors note that the high P/E ratio indicates high expectations for future growth, while the forward P/E implies a more attractive valuation going forward.

Short-Term Price Predictions (2025)

This section examines the near-term forecast for SAM stock. The short-term forecast focuses on price action for the next five days to one month.

5-Day to 1-Month Forecast

Recent trading shows moderate upward momentum. During the next five days, SAM is expected to trade within a range that reflects the current technical levels. Over the one-month period, analysts project a modest rise in the stock price, moving closer to the consensus target. A short-term gain in the range of 2% to 5% is possible, driven by positive earnings sentiment and market recovery following a slight pre-market decline.

Drivers Behind the Short-Term Forecast

The following factors influence the short-term forecast for SAM:

- Earnings Announcement: The upcoming earnings report on April 24, 2025, is anticipated to have a significant impact. Positive surprises in EPS could push the stock higher.

- Volume Trends: A moderate trading volume of approximately 170,000 shares supports steady price action.

- Market Conditions: Overall market performance and consumer spending trends affect SAM stock due to its position in the consumer staples sector.

- Brand Strength: The strong portfolio of brands such as Samuel Adams and Angry Orchard reinforces investor confidence.

- Technical Support: Key technical levels, including the 50-day moving average near $237.54 and the 200-day moving average around $276.19, serve as potential support and resistance points.

Short-term investors should monitor these indicators and keep an eye on news related to product launches and marketing efforts.

Long-Term Price Predictions (2025–2030)

This section outlines the long-term forecast for SAM over the next five years. The projections are based on revenue growth, earnings expectations, and market trends.

Yearly Forecast Summary

Below is an estimated yearly summary for SAM from 2025 through 2030. The table presents projected revenue, earnings per share (EPS), and growth outlook for each year. These figures are derived from consensus estimates and industry research.

| Year | Estimated Revenue (B USD) | EPS Estimate | Growth Outlook |

|---|---|---|---|

| 2025 | 2.07 | 9.97 | Stable improvement |

| 2026 | 2.13 | 11.66 | Moderate growth |

| 2027 | 2.18* | 13.55* | Continued steady growth |

| 2028 | 2.25* | 14.50* | Gradual improvement |

| 2029 | 2.30* | 15.20* | Consistent performance |

| 2030 | 2.38* | 16.00* | Upward trend |

*These projections use current trends and analyst forecasts.

(Source: Yahoo Finance and internal market analysis)

Revenue growth remains modest. Analysts expect a slight increase in revenue each year, while EPS growth indicates improving profitability. The forward P/E ratio dropping to around 24.92 suggests that investors may see better value over time.

Long-Term Catalysts

Several factors may drive the long-term performance of SAM:

- Consumer Trends: Increased consumer demand for premium alcoholic beverages supports revenue growth.

- New Product Introductions: Launching new variants and hard seltzers can boost market share.

- Distribution Expansion: Expanding distribution channels, including online sales, will benefit long-term performance.

- Brand Loyalty: A loyal customer base for established brands like Samuel Adams underpins future earnings.

- Regulatory Environment: Favorable regulatory changes in alcohol marketing and distribution can act as growth drivers.

These long-term catalysts reinforce the expectation of a steady upward trend in stock performance.

Technical Analysis

Technical analysis offers insights into the stock’s price trends and helps identify entry and exit points. We examine moving averages, momentum indicators, and volatility.

Moving Averages

Moving averages smooth price data to reveal the underlying trend. For SAM, the 50-day and 200-day moving averages are essential:

- 50-Day Moving Average: Approximately $237.54. This level acts as a short-term support zone.

- 200-Day Moving Average: Approximately $276.19. This indicator shows a longer-term trend and potential resistance.

The proximity of the current price to the 50-day average suggests that the stock is near a key support level. Investors should monitor these averages for signs of reversal or breakout.

Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) help gauge buying and selling pressure:

- RSI: An RSI between 50 and 60 indicates balanced market pressure.

- MACD: The MACD line is near its signal line, suggesting consolidation with potential for short-term gains following a positive earnings report.

Momentum indicators are supported by trading volume data. These technical tools confirm a phase of consolidation, where a clear directional trend is yet to emerge. Data from Yahoo Finance provides current momentum metrics.

Volatility Analysis

Volatility is measured using beta and historical price swings:

- Beta: A beta of 1.26 implies that SAM is somewhat more volatile than the market average.

- 52-Week Range: The stock has moved between $215.10 and $339.77 over the past year. This range provides context for potential support and resistance levels.

Volatility analysis is vital for setting risk management parameters. Investors can use stop-loss orders to protect against adverse movements. These indicators are commonly referenced on platforms such as NYSE and Yahoo Finance.

Investment Potential & ROI Scenarios

This section examines various investment horizons and the potential return on investment (ROI) for SAM stock.

Short-Term Investment: 1 Month

For a one-month holding period, the expected return is modest. With a slight upward momentum and the upcoming earnings report, investors might see a price gain between 2% and 5%. Short-term returns can also be influenced by intraday volatility and market reactions to news.

Key Drivers:

- Positive earnings expectations.

- Increased trading volume near support levels.

- Favorable market sentiment in the consumer staples sector.

Investors seeking a short-term position should consider technical entry points and the timing of the earnings report.

Medium-Term Investment: 1 Year

A one-year investment horizon provides more time for the market to reflect improvements in revenue and EPS. Analysts project revenue growth of around 2.5% to 3% annually, while EPS may rise significantly, driven by cost management and product innovation.

Key Drivers:

- Steady revenue improvement.

- Continued product innovation and market penetration.

- Consolidation of market share in a competitive sector.

Over one year, investors may expect ROI in the range of 8% to 12%, combining capital appreciation with the effect of improved profitability metrics.

Long-Term Investment: 5 Years (2030)

Long-term investors have the potential to benefit from a more pronounced upward trend. Forecasts indicate steady revenue and EPS growth, and the stock is expected to approach the higher end of the price range by 2030.

Key Drivers:

- Expansion into new markets and product lines.

- Strong brand equity and consumer loyalty.

- Strategic initiatives in distribution and digital sales.

The long-term ROI scenario, based on compounded annual growth, may yield an annualized return of 10% to 15%. This scenario is supported by a combination of steady revenue gains and improved margins over the long run.

The table below summarizes the ROI scenarios:

| Investment Horizon | Expected ROI | Key Influencers |

|---|---|---|

| 1 Month | 2% – 5% | Earnings report, technical support levels |

| 1 Year | 8% – 12% | Revenue growth, product innovation |

| 5 Years (2030) | 10% – 15% (annualized) | Market expansion, brand loyalty, margin gains |

Monthly Forecast Breakdown (2025)

A month-by-month breakdown for 2025 provides further detail on expected market behavior. This section covers key months that are likely to influence the stock’s performance.

March 2025

In March, the market may see increased activity due to preparatory moves ahead of the earnings announcement. Investors often position themselves in anticipation of positive results. Trading volumes could rise, and the stock may trade near its 50-day moving average, offering a short-term support level.

Expected Price Action:

- Moderate volatility.

- A stable price close to technical support levels.

April 2025

April is critical with the earnings report scheduled for April 24, 2025. Volatility might increase during the earnings release. Investors should expect short-term fluctuations, especially if the earnings report deviates from forecasts.

Expected Price Action:

- Increased volatility during the earnings announcement.

- A potential dip before a recovery if results are strong.

May 2025

Post-earnings, May may show a stabilization of the stock price. The market will likely digest the earnings data and adjust the technical levels accordingly. This period could see consolidation and a modest upward trend as investor sentiment improves.

Expected Price Action:

- Consolidation of gains from the previous month.

- A steady trend, supported by technical indicators.

November 2025

Towards the end of the year, November is typically a period for reassessment. Investors may adjust positions ahead of fiscal year-end reviews. Market dynamics could lead to a gradual price increase if consumer spending remains strong.

Expected Price Action:

- A gradual upward trend as investors position for year-end results.

- Increased activity in response to economic and sector-specific reports.

The monthly breakdown table below outlines these expectations:

| Month | Key Events/Indicators | Expected Price Behavior |

|---|---|---|

| March | Pre-earnings positioning, volume increase | Moderate volatility, stable support |

| April | Earnings report (Apr 24, 2025) | High volatility, potential dip and rebound |

| May | Post-earnings consolidation | Steady trend, technical support evident |

| November | Fiscal year-end adjustments | Gradual rise, increased market activity |

Risk Factors & Market Dynamics

Evaluating risk is essential when considering an investment in SAM. The following sections outline both external and internal risks that could influence the stock’s performance.

External Risks

- Economic Cycles: Changes in consumer spending and economic downturns may impact revenue.

- Regulatory Changes: New regulations in the alcohol industry may affect marketing and distribution.

- Competitive Pressure: Increased competition from other beverage companies may challenge market share.

- Global Uncertainties: Trade issues and geopolitical events can introduce market volatility.

Investors should keep a close watch on economic indicators and industry news to manage these risks.

Internal Risks

- Operational Efficiency: Any issues in production or supply chain disruptions could hurt profitability.

- Product Performance: Poor reception of new product lines may affect sales.

- Management Decisions: Strategic changes or leadership transitions might create short-term uncertainty.

- Cost Structure: Rising input costs or inefficiencies may lead to margin pressure.

Understanding these risks helps investors develop a balanced portfolio and set appropriate stop-loss orders.

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

Historical Performance & Analyst Ratings

A review of historical performance and analyst ratings provides context for SAM’s current valuation and future prospects.

Historical Stock Price

The historical data for SAM shows a wide range in annual price movements. The table below provides a snapshot of annual price data:

| Year | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2025 | 301.76 | 302.68 | 215.10 | 246.36 | 13,365,554 |

| 2024 | 344.83 | 371.65 | 254.40 | 299.98 | 37,869,831 |

| 2023 | 330.00 | 420.50 | 296.27 | 345.59 | 31,258,840 |

| 2022 | 503.54 | 535.00 | 287.00 | 329.52 | 41,894,035 |

| 2021 | 991.14 | 1,349.98 | 435.12 | 505.10 | 61,402,915 |

This historical performance indicates that SAM has experienced significant fluctuations. Price peaks and corrections have defined its trajectory. Such trends are useful for identifying key support and resistance levels.

Analyst Consensus

Analyst ratings currently lean toward a “Hold” rating. The consensus price target of $289.44 implies an upward potential of about 17.5% from the current price. Below is a summary of analyst recommendations:

| Rating Category | Analyst Trend | Comments |

|---|---|---|

| Strong Buy | Limited | Few analysts recommend a strong buy |

| Buy | Moderate | Some analysts see room for moderate gains |

| Hold | Majority | Most maintain a hold stance based on fundamentals |

| Underperform | Few | Limited concerns regarding performance |

| Sell | None | No significant sell recommendations |

The majority “Hold” rating reflects the balance between growth potential and existing risks.

Frequently Asked Questions (FAQs)

Q1: What is the current trading price for SAM?

The stock closed at $246.36 on April 2, 2025. Pre-market trading recorded a price of $242.01 on April 3, 2025.

Q2: What are the key financial metrics for The Boston Beer Company?

Key metrics include a market cap of $2.73B, revenue of $2.01B (ttm), net income of $59.56M, and EPS of 5.06. The stock has a P/E ratio of 48.67 and a forward P/E of 24.92.

Q3: What is the short-term forecast for SAM in 2025?

Over the next five days to one month, the stock is expected to gain between 2% and 5% as it nears its technical support levels and in anticipation of the April earnings report.

Q4: What long-term growth can investors expect from SAM?

Long-term projections for 2025–2030 suggest modest revenue growth and improved EPS. The stock may achieve annualized returns of 10% to 15% over a five-year period.

Q5: Which technical indicators are important for SAM analysis?

The analysis focuses on moving averages (50-day and 200-day), momentum indicators (RSI, MACD), and volatility measures (beta and historical price range).

Conclusion

The Boston Beer Company stands as a significant player in the beverage industry. This detailed forecast shows that SAM’s stock exhibits a balanced mix of growth potential and risk. In the short term, the stock may experience modest gains driven by the upcoming earnings announcement and positive technical signals. Over the long term, steady revenue and EPS growth could support an annualized return between 10% and 15% by 2030.

Investors should consider both external influences, such as economic cycles and regulatory changes, and internal factors, including product performance and operational efficiency. The current “Hold” rating reflects market caution amid high expectations for future performance. By monitoring key technical levels and fundamental data, stakeholders can make informed decisions.