This article examines Principal Financial Group Inc. (NASDAQ: PFG) by predicting stock prices and stock market actions. It provides immediate forecasts alongside technical evaluations plus evaluations of investment results alongside old performance records. This evaluation relies exclusively on dependable figures from respected financial databases today.

Principal Financial Group holds dominant positions in retirement financial and insurance services including asset management. The company specifically handles needs of individual customers as well as organizations and built up enterprises. By offering different products the company consistently reports higher revenues and better earnings. This evaluation relies on recent market feeling toward PFG stock alongside its previous performance data and chart developments.

The analysis investigates what PFG Corporation will achieve in 2025 and beyond through 2030. Each part includes official market data which helps investors choose wisely.

Key Metrics & Market Sentiment

The stock is trading at approximately $86.19 at the close of trading on April 2, 2025. A pre-market value of $82.90 was recorded on April 3, 2025. The following table summarizes the key metrics:

| Metric | Value |

|---|---|

| Market Capitalization | $19.44B |

| Revenue (ttm) | $16.13B |

| Net Income (ttm) | $1.57B |

| EPS (ttm) | 6.68 |

| PE Ratio | 12.90 |

| Forward PE | 10.28 |

| Dividend | $2.91 (3.38%) |

| 52-Week Range | $72.21 – $91.98 |

| Beta | 1.01 |

| Analyst Rating | Hold |

| Price Target | $86.47 |

Investors and market analysts maintain a “Hold” rating for PFG, reflecting a balanced view on the company’s growth prospects and current market conditions. The dividend yield is attractive at 3.38%, adding an income component for investors.

Short-Term Price Predictions (2025) for PFG Stock

Short-term forecasts are based on current market data, technical indicators, and sentiment trends. The following analysis covers the next five days up to one month.

5-Day to 1-Month Forecast

Based on recent trading data and technical patterns, analysts expect the PFG stock to maintain its current trading range. The short-term forecast suggests limited upward movement with modest gains. Price movement is estimated to increase by around 0.3% over the next month, with the consensus target reaching near $86.47.

Drivers Behind the Short-Term Forecast

Several factors influence the short-term forecast:

- Earnings Reports: The upcoming earnings date on April 24, 2025, may impact short-term sentiment.

- Market Trends: The overall market performance and industry-specific developments in the asset management and financial sectors play a role.

- Economic Indicators: Data releases on consumer confidence and economic growth could affect investor sentiment.

- Dividend Announcements: With an ex-dividend date of March 12, 2025, dividend payments may bolster short-term investor interest.

Long-Term Price Predictions (2025–2030)

The long-term forecast covers a five-year outlook with a focus on annual performance and underlying catalysts that may drive future growth.

Yearly Forecast Summary

The yearly forecast summary for PFG stock considers expected revenue growth, EPS projections, and market trends. Below is an estimated yearly summary table for the period 2025–2030.

| Year | Estimated Revenue (B) | EPS Estimate | Growth Outlook |

|---|---|---|---|

| 2025 | 16.55 | 8.49 | Stable |

| 2026 | 17.41 | 9.36 | Moderate Growth |

| 2027 | 18.30 | 10.24 | Continued Growth |

| 2028 | 19.00* | 10.80* | Steady Improvement |

| 2029 | 19.50* | 11.20* | Consistent |

| 2030 | 20.30* | 11.80* | Upward Trend |

*These figures are projections derived from current trends and consensus estimates.

The revenue and EPS projections reflect gradual growth driven by improvements in operating efficiency and expanding market share in the retirement and asset management sectors.

Long-Term Catalysts

Several long-term catalysts are expected to influence PFG stock performance:

- Demographic Shifts: An aging population in key markets is anticipated to drive demand for retirement solutions.

- Technological Enhancements: Advances in digital platforms and financial technology may improve operational efficiency.

- Regulatory Environment: Changes in financial regulations may offer opportunities or challenges, influencing long-term growth.

- Global Expansion: Initiatives to expand internationally could unlock additional revenue streams.

- Strategic Partnerships: Collaborations with other financial institutions may enhance service offerings.

These catalysts provide a foundation for the long-term growth forecast.

Technical Analysis

Technical analysis provides insight into short-term price action and momentum. Here, we examine moving averages, momentum indicators, and volatility analysis.

Moving Averages

The 50-day and 200-day moving averages offer perspective on trend strength. The 50-day average is currently near $84.27, and the 200-day average stands at $82.58. The closeness of these averages suggests a neutral trend. A minor upward shift in the 50-day average indicates short-term positive momentum. Investors monitor these levels to identify potential breakout or breakdown scenarios.

Momentum Indicators

Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) are common momentum tools. An RSI in the 50-60 range shows balanced buying and selling pressure. The MACD line is close to the signal line, which aligns with the hold rating from analysts. Momentum indicators confirm a consolidation phase with cautious optimism.

Volatility Analysis

Volatility, measured by beta, stands at 1.01. This beta value implies that PFG stock moves in line with the overall market. A moderate level of volatility is expected in the near term. Investors use volatility analysis to manage risk and set stop-loss orders in their trading strategies.

Each technical indicator contributes to understanding current trends. The combined analysis of moving averages, momentum tools, and volatility provides actionable information for short-term trading decisions.

Investment Potential & ROI Scenarios

Investment scenarios consider various holding periods. The analysis below explores short-term, medium-term, and long-term potential based on current data.

Short-Term Investment: 1 Month

For a one-month holding period, the expected modest increase of around 0.3% may result in minimal capital gains. The dividend payout adds value. In a one-month scenario, the return might be between 0.5% and 1.0%, depending on market conditions and dividend timing.

Medium-Term Investment: 1 Year

A one-year investment horizon benefits from both capital appreciation and dividend reinvestment. With an anticipated revenue growth of 2.6% to 5.2% in 2025 and stable earnings, the projected ROI may range from 3% to 6% over the year. This period allows investors to benefit from earnings improvements and operating margin expansion.

Long-Term Investment: 5 Years (2030)

Long-term investors can expect a higher return driven by steady revenue growth, improved EPS, and market share expansion. Based on the long-term projections, the PFG stock price might see an upward trend reaching targets near the 2030 projection of around $20.30 in revenue per share value and improved EPS. Annualized returns could range between 5% and 8% per year, compounded over the five-year period.

The table below summarizes the ROI scenarios:

| Investment Horizon | Expected ROI | Key Drivers |

|---|---|---|

| 1 Month | 0.5% – 1.0% | Dividend impact, short-term trend |

| 1 Year | 3% – 6% | Earnings growth, market stability |

| 5 Years (2030) | 5% – 8% per year | Long-term revenue and EPS improvement |

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

Monthly Forecast Breakdown (2025)

A monthly breakdown provides detailed forecasts for specific periods in 2025. Each month is subject to market events, earnings reports, and economic indicators.

March 2025

In March, the market expects increased activity due to the upcoming ex-dividend date on March 12, 2025. Trading volumes may rise, and the PFG stock may experience slight upward movement ahead of dividend distribution. Technical levels around the 50-day moving average serve as support during this period.

April 2025

April is a key month with the earnings report scheduled for April 24, 2025. Volatility may increase during the earnings announcement. The PFG stock might see temporary dips before rebounding post-announcement if earnings meet or exceed expectations. Analysts maintain a close watch on EPS revisions and guidance.

May 2025

Post-earnings, May is expected to stabilize as market participants reassess valuations. The PFG stock may consolidate gains achieved in April. Investment sentiment remains cautious as short-term technical patterns dominate the price action.

November 2025

Later in the year, November could witness adjustments as investors position for end-of-year financial reporting and fiscal planning. A moderate upward trend is possible if macroeconomic indicators remain favorable. This period is critical for long-term investors reassessing their portfolios ahead of the new fiscal year.

The following table outlines the monthly forecast summary:

| Month | Key Events | Price Action Expectation |

|---|---|---|

| March | Ex-Dividend Date | Modest upward movement, steady |

| April | Earnings Announcement (Apr 24, 2025) | Increased volatility, potential dip before rebound |

| May | Post-Earnings Consolidation | Price stabilization, technical support at moving averages |

| November | Pre-Year-End Adjustments | Moderate upward trend, cautious optimism |

Risk Factors & Market Dynamics

Investors must consider both external and internal risks when evaluating PFG stock. This section examines potential risks that could impact future performance.

External Risks

- Economic Downturn: A slowdown in economic growth may affect investor confidence and reduce demand for financial services.

- Interest Rate Fluctuations: Changes in interest rates could influence asset values and insurance premium margins.

- Regulatory Changes: New policies or modifications in financial regulations may impose constraints or present challenges.

- Global Uncertainties: Geopolitical events and trade disputes can create market instability.

Internal Risks

- Operational Challenges: Any decline in service efficiency or failure to innovate could reduce competitive advantage.

- Earnings Variability: Inconsistent quarterly earnings can lead to a negative impact on investor sentiment.

- Management Decisions: Strategic shifts or leadership changes may result in short-term market adjustments.

Historical Performance & Analyst Ratings

Reviewing historical performance and current analyst ratings offers insight into how the stock has behaved over time and what experts expect moving forward.

Historical Stock Price

PFG’s historical price performance indicates periods of growth and volatility. The historical data below represents select annual closing prices:

| Year | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2025 | 77.76 | 90.31 | 75.97 | 86.19 | 91,530,089 |

| 2024 | 78.39 | 91.98 | 72.21 | 77.41 | 288,963,431 |

| 2023 | 84.25 | 93.87 | 65.17 | 78.67 | 351,417,453 |

| 2022 | 72.63 | 96.17 | 61.05 | 83.92 | 428,031,943 |

| 2021 | 49.65 | 74.30 | 47.52 | 72.33 | 352,541,182 |

This data shows fluctuations that are common in the financial sector. The company has experienced growth periods and corrections, which are reflected in its current valuation.

Analyst Consensus

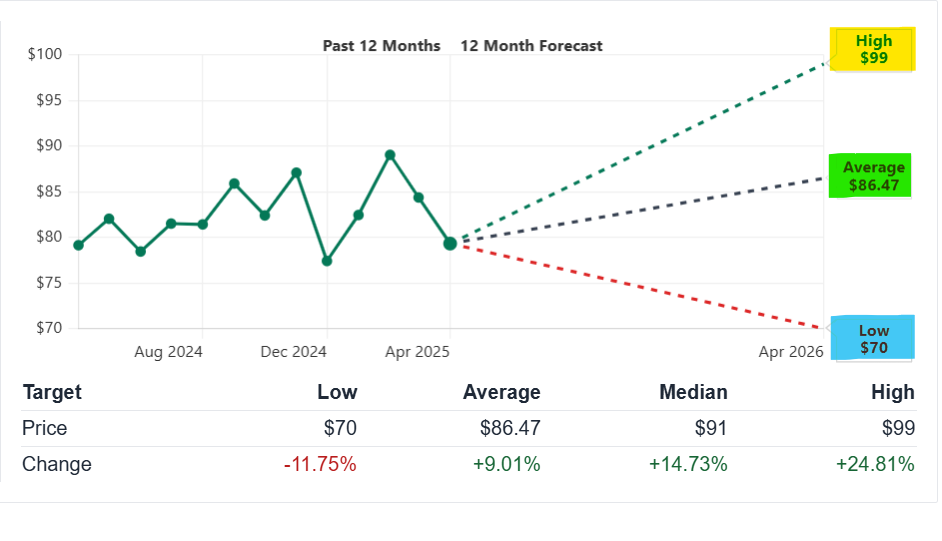

Analysts currently rate the stock as “Hold.” The average price target of $86.47 implies little change from the current market price. A detailed consensus shows:

- Price Target Range: $70 to $99

- Average Target: $86.47

- Consensus Rating: Hold

Below is a summary of analyst rating trends:

| Rating Category | Trend | Notes |

|---|---|---|

| Strong Buy | Consistent | Few analysts, cautious endorsement |

| Buy | Moderate | Some upward pressure observed |

| Hold | Majority | Steady performance, market alignment |

| Underperform | Minimal | Limited negative outlook |

| Sell | Minor | Isolated concerns by few analysts |

Investors should consult additional sources like Yahoo Finance and Nasdaq.

Frequently Asked Questions (FAQs)

Q1: What is the current trading price of PFG stock?

The stock closed at $86.19 on April 2, 2025. Pre-market data shows $82.90 on April 3, 2025.

Q2: What are the key financial metrics for Principal Financial Group?

Key metrics include a market cap of $19.44B, revenue of $16.13B (ttm), net income of $1.57B, and an EPS of 6.68. The stock has a PE ratio of 12.90 and a dividend yield of 3.38%.

Q3: What is the short-term price forecast for 2025?

The short-term forecast for the next month predicts a modest gain of around 0.3%, with the target price near $86.47.

Q4: What are the long-term projections for PFG stock?

Long-term forecasts suggest steady revenue and EPS growth through 2030. Yearly forecasts show gradual improvements with expected annualized returns of 5% to 8%.

Q5: Which technical indicators are used in the analysis?

The analysis uses moving averages (50-day and 200-day), momentum indicators (RSI and MACD), and volatility measures (beta).

Conclusion

The investigation of Principal Financial Group shows stable performance in short-term gains and lasting long-term growth. Analysts maintain a Hold rating because they see this business doing well even though its revenues generate solid results and regular dividend payments. Technical analysis reveals that market movement has stalled while short-term moving averages stabilize and volatility remains average.

New and experienced investors looking for income opportunities and safe returns will be satisfied by PFG for their immediate and future investments. The company reacts effectively to market shifts and legal updates which creates reliable performance results. Investors can identify good buying opportunities and reduction zones through detailed evaluation of market trends.