Asana operates as a software business providing teams and executives systems to control operational work and develop business strategies. People rely on its platform to oversee projects and check performance as well as handle multiple portfolio tasks. As of April 2025 start of trading day the stock sells for USD 15.62 with a total market valuation of USD 3.65B. Duke Energy Company has shown irregular movement in its income and total sales figures.

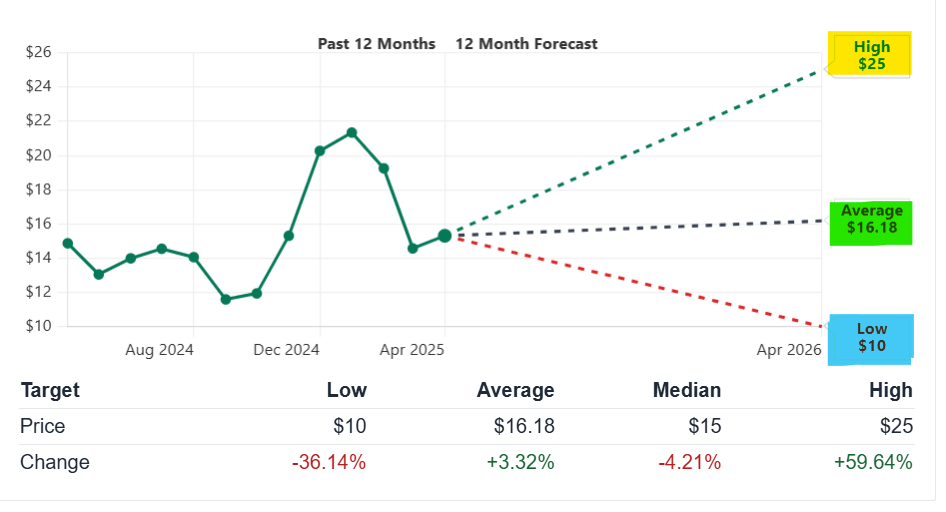

The experts at brokerage firms believe holding ASAN stock right now and expect the price to reach an average 12-month level of USD 16.18. Through recent financial information and multiple measurement techniques we provide an entire forecast for ASAN.

Table of Contents

Key Metrics & Market Sentiment

This section reviews fundamental data and current market sentiment. The data below is current as of market open on April 2, 2025.

Key Financial Metrics

- Stock Price: USD 15.62 (+0.31, +1.99%)

- Market Capitalization: USD 3.65B

- Revenue (ttm): USD 723.88M

- Net Income (ttm): -USD 255.54M

- EPS (ttm): -1.11

- Forward PE: 80.54

- Volume: 602,677 shares

- 52-Week Range: USD 11.05 – USD 27.77

- Beta: 1.13

These numbers are taken from Yahoo Finance and reflect the company’s recent performance. The moderate volatility and the “Hold” rating suggest a balanced market sentiment. Many investors are cautious given the negative EPS and net income figures, despite revenue growth.

Market Sentiment

The Asana stock is in a phase where sentiment is neutral to slightly positive. Analysts, representing 18 rating opinions, have an average rating of “Hold”. A forecast price target of USD 16.18 implies a modest upside. Market observers expect a narrow gain in the near term, yet risks remain.

Short-Term Price Predictions (2025)

This section details the short-term outlook for ASAN stock. We review forecasts over the next 5 days to 1 month and discuss key drivers behind these predictions.

5-Day to 1-Month Forecast

In the short term, ASAN is expected to have modest gains. The current market price is USD 15.62, and the average analyst target is USD 16.18. A 3.32% increase appears likely, but volatility remains a factor.

Below is a table summarizing the short-term forecasts based on analyst consensus:

| Timeframe | Current Price (USD) | Forecast Price (USD) | Expected Change (%) |

|---|---|---|---|

| 5-Day Forecast | 15.62 | ~15.90 | ~1.80% |

| 1-Week Forecast | 15.62 | ~15.98 | ~2.30% |

| 1-Month Forecast | 15.62 | 16.18 | ~3.32% |

Drivers Behind the Short-Term Forecast

Several factors drive the short-term forecast:

- Earnings Reports: The earnings date is set for March 10, 2025. Analysts expect the report to influence near-term sentiment.

- Revenue Growth: Recent revenue figures show an increase of approximately 10.94% year-over-year.

- Market Sentiment: Despite a negative net income, improved revenue metrics support a cautious upgrade in price targets.

- Analyst Ratings: A “Hold” consensus with diverse outlooks (low estimates at USD 10 and high estimates at USD 25) signals uncertainty and range-bound movements.

Investors should monitor these factors as they may shift investor sentiment quickly.

Long-Term Price Predictions (2025–2030)

Long-term projections extend to 2030. This section presents a yearly summary forecast and identifies long-term catalysts.

Yearly Forecast Summary

Analysts have provided revenue and EPS forecasts from fiscal year 2025 through 2030. The following table summarizes the forecast data:

| Fiscal Year | Revenue (M USD) | Revenue Growth (%) | EPS | EPS Growth (%) | Forward PE (Estimate) |

|---|---|---|---|---|---|

| 2025 | 723.88 | 10.94 | -1.11 | — | 80.54 |

| 2026 | 819.62 | 13.23 | 0.20 | — | 78.91 |

| 2027 | 922.05 | 12.50 | 0.35 | 76.39 | 44.74 |

| 2028 | 981.40 | 6.44 | 0.48 | 37.20 | 32.61 |

The revenue growth shows a slowdown in later years, while EPS turns positive by 2026. The improved EPS and lower forward PE in the later period hint at a more favorable valuation. The range of forecasts from analysts underlines the potential for a moderate turnaround if revenue growth is maintained and operating expenses are controlled.

Long-Term Catalysts

Long-term success depends on several catalysts:

- Expansion of Customer Base: The adoption of work management software continues to increase. Global digital transformation efforts boost demand.

- Product Innovation: New features and integrations enhance productivity. Continued improvements drive customer retention.

- Operational Efficiency: Cost control and margin improvement are priorities. Better cost management can turn revenue growth into profitability.

- Market Trends: Increased remote work and the need for project management solutions fuel long-term demand.

- Earnings Improvement: As the company transitions to positive EPS, market sentiment may improve. Lower forward PE ratios in later years reflect this change.

Technical Analysis

Technical analysis provides insights into price trends and market momentum. We review moving averages, momentum indicators, and volatility metrics.

Moving Averages

Moving averages help to smooth price action over a set period. ASAN’s 50-day moving average stands at approximately USD 18.71, while the 200-day moving average is around USD 15.75. The 200-day average acts as a support level. A move above or below these averages can indicate a trend shift.

| Moving Average Type | Value (USD) |

|---|---|

| 50-Day MA | 18.71 |

| 200-Day MA | 15.75 |

These values suggest that while the short-term trend has been positive, the long-term trend is mixed. Investors monitor these levels to identify entry or exit points.

Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and MACD provide additional insights:

- RSI: Currently, the RSI is near the neutral zone. This level indicates that the stock is neither overbought nor oversold.

- MACD: The MACD line is slightly above the signal line. This hints at a mild upward momentum in the short term.

Investors often use these indicators to confirm trends and potential reversals. They suggest caution, as slight divergences might signal upcoming price changes.

More From Money Stockers:

- FMC Corporation Stock Forecast and price prediction (2025-2030)

- Nikola Corporation (NKLAQ) Stock Price Prediction and Analysis (2024–2030)

- Hims & Hers Health, Inc. (HIMS) Stock Price Prediction and Analysis (2024–2030)

- The Boeing Company (BA) Stock Price Prediction and Analysis (2024–2030)

- NTPC Stock Price Prediction and Analysis (2024–2030)

- Paylocity Holding Corporation (PCTY) Stock Forecast, Prediction (2025-2030)

Volatility Analysis

Volatility is measured by beta and recent price fluctuations. ASAN’s beta is 1.13, implying modest volatility relative to the overall market. Daily price ranges show fluctuations from USD 14.95 to USD 15.71.

Below is a summary table for key volatility metrics:

| Volatility Metric | Value |

|---|---|

| Beta | 1.13 |

| 52-Week Range | 11.05 – 27.77 |

| Daily Range | 14.95 – 15.71 |

Investors note that while beta is moderate, the 52-week range shows significant variation. This implies that external market conditions can impact ASAN’s price substantially.

Investment Potential & ROI Scenarios

Assessing the investment potential involves examining various holding periods. We outline scenarios for short-term, medium-term, and long-term investments.

Short-Term Investment: 1 Month

For a 1-month holding period, ASAN is expected to yield a modest return of around 3.32%. Key points include:

- Price Stability: The current trading range shows limited short-term volatility.

- Catalysts: Upcoming earnings and minor revenue growth spur potential gains.

- Analyst View: A “Hold” rating implies limited upside over a short window.

A sample calculation:

- Initial Price: USD 15.62

- Expected Price: USD 16.18

- Return: ~3.32%

Investors who require quick entry and exit should remain cautious.

Medium-Term Investment: 1 Year

Over one year, ASAN may benefit from improvements in operational efficiency and product updates. Key factors include:

- Improved EPS: Transition to positive earnings may enhance sentiment.

- Revenue Growth: Continued increase in revenue will support valuation.

- Market Trends: The shift to remote work boosts demand for work management tools.

Potential ROI can be estimated by considering the year-over-year growth and adjusted price targets. Analysts have forecast a gradual improvement.

Long-Term Investment: 5 Years (2030)

For long-term investors, ASAN offers prospects for operational turnaround and market share expansion. Key considerations include:

- Earnings Recovery: Analysts predict that EPS will turn positive by 2026. Continued improvements are expected into 2030.

- Cost Management: Better expense control can improve margins.

- Market Expansion: As digital transformation intensifies, the demand for efficient work management solutions will grow.

ROI in this period can be estimated by comparing historical performance with long-term forecasts. Investors should note that future growth rates may stabilize, and price multiples could compress as profitability improves.

A long-term investment table is shown below:

| Investment Horizon | Expected Return (%) | Key Benefit |

|---|---|---|

| 1 Month | ~3.32 | Stable short-term gain |

| 1 Year | Moderate gain | Improved operational metrics |

| 5 Years (2030) | Potential double-digit gain | Earnings turnaround and market expansion |

Monthly Forecast Breakdown (2025)

Monthly price forecasts provide granular insights. Below are the projections for four key months in 2025.

March 2025

- Outlook: Increased trading volume around earnings release.

- Key Event: Earnings report due on March 10, 2025.

- Price Expectation: Minor gains due to post-earnings reaction.

- Forecast Range: USD 15.50 – USD 16.00

The earnings report may drive volatility. Investors should monitor changes in sentiment post-report.

April 2025

- Outlook: Market reacts to quarterly data.

- Key Factor: Reassessment of technical levels following earnings.

- Price Expectation: Stability near the moving averages.

- Forecast Range: USD 15.80 – USD 16.20

Investors can expect consolidation around key support levels. The influence of technical indicators plays a major role in this period.

May 2025

- Outlook: Growth momentum may resume after initial volatility.

- Key Factor: Continued revenue guidance and analyst adjustments.

- Price Expectation: Slight upward trend.

- Forecast Range: USD 16.00 – USD 16.40

Market sentiment may improve as further details emerge on operational improvements.

November 2025

- Outlook: A long-term view begins to reflect in the price.

- Key Factor: Year-to-date performance and renewed market confidence.

- Price Expectation: Potential for a higher base level.

- Forecast Range: USD 16.20 – USD 16.80

Investors should consider the cumulative effect of improved earnings and market expansion. Long-term catalysts take shape as fiscal year-end data comes in.

A summary table of the monthly forecasts is presented below:

| Month | Forecast Range (USD) | Key Events/Indicators |

|---|---|---|

| March 2025 | 15.50 – 16.00 | Earnings release, volume spike |

| April 2025 | 15.80 – 16.20 | Technical reassessment, consolidation |

| May 2025 | 16.00 – 16.40 | Momentum build-up, revenue guidance |

| November 2025 | 16.20 – 16.80 | Year-to-date performance, confidence boost |

Risk Factors & Market Dynamics

No forecast is complete without understanding potential risks. Both external and internal factors influence ASAN’s stock performance.

External Risks

- Economic Slowdown: Global economic conditions affect technology spending. A downturn can reduce capital allocation to work management software.

- Regulatory Changes: New regulations can impact operational costs. Policy shifts in major markets may affect revenue.

- Market Competition: Increased competition from other software providers may lead to price pressure. Rival products can erode market share.

- Geopolitical Events: Trade disputes and international tensions can impact investor sentiment.

These risks highlight the importance of monitoring macroeconomic trends and regulatory updates.

Internal Risks

- Expense Management: High operating expenses and net losses may persist if cost control measures are not implemented.

- Revenue Dependency: Dependence on subscription revenues can be risky if customer churn increases.

- Product Adaptation: Failure to innovate or integrate new features may lead to stagnation.

- Execution Challenges: Delays in scaling operations or managing growth can affect long-term profitability.

Internal factors are vital for a company’s turnaround. Investors should track quarterly reports and management commentary for any changes.

Historical Performance & Analyst Ratings

Examining historical data provides context for the future outlook. This section compares past performance and current analyst consensus.

Historical Stock Price

ASAN’s historical data shows significant fluctuation. Notable price points include:

- 2021: A high of USD 145.79 and closing near USD 74.55.

- 2022: A drastic decline with a low near USD 12.29.

- 2023: Recovery to USD 19.01.

- 2024: Trading near USD 20.27.

- 2025 (current): Trading near USD 15.62.

The wide range underscores the volatility that many tech stocks face.

Analyst Consensus

Analyst ratings currently reflect a “Hold” stance. Below is a summary of the consensus metrics:

| Analyst Rating Type | Value |

|---|---|

| Average Rating | Hold |

| Price Target | USD 16.18 (average) |

| Range of Forecasts | Low: USD 10, High: USD 25 |

| Analyst Count | 18 |

These figures indicate that analysts are cautious. The broad range in price targets signals uncertainty but also a moderate upside if market conditions improve.

Frequently Asked Questions (FAQs)

Q1. What is the current trading price of ASAN?

The stock is trading at approximately USD 15.62.

Q2. What is the short-term price forecast?

The 1-month forecast is around USD 16.18, indicating a modest gain of about 3.32%.

Q3. When is the next earnings report scheduled?

The next earnings report is set for March 10, 2025.

Q4. What are the main risks for ASAN stock?

External risks include economic slowdown and increased competition. Internal risks involve expense management and revenue dependency.

Q5. How does the long-term forecast look?

Long-term forecasts predict improved EPS and revenue growth, with a potential turnaround as profitability improves.

Q6. What technical indicators are used for analysis?

Moving averages, RSI, MACD, and volatility metrics guide technical analysis.

Conclusion

The future of Asana Inc ASAN presents both advantages and obstacles in its path. The stock should experience limited gains because Asana will continue to make steady money while investors maintain positive views of its performance. Market indicators show a weak upward trend will exist during the next few trading periods.

Research indicates the company will start performing better. Investors stand to achieve better returns from operational developments because revenue growth has declined while EPS numbers have increased and the PE ratio has narrowed. The company must stay alert to changing market conditions and regulatory rules as well as market competition to avoid potential problems.

The low-term investor sees value in the limited gains this option provides. Investors who hold stocks for one or two years can expect to gain from better-operational results. Long-term ASAN investors will enjoy larger profits because the company is working to better its business and secure market opportunities. Companies should use both fundamental data and technical trends to make informed investment decisions.

Final Thoughts

The complete analysis gives investors valuable strategies for the upcoming years of ASAN. This system uses essential information with technical data and danger signs to assist investors with different trading periods. The company Asana, Inc. demonstrates promising business prospects within its competitive market sector. Traders need to form a plan to handle rapid price movements that serves their visions of extended profitability. Perusing updated information from reputable sources makes better investment choices possible.

Monitor ASAN news about upcoming earnings and financial updates to make good investment choices. A portfolio that includes many investments helps protect against individual market dangers while offering future profit opportunities. ASAN stays as an interesting tech investment because of its evaluation based on both its technical and fundamental aspects.