This article presents an in-depth analysis of Advanced Micro Devices, Inc. (AMD) stock forecast. The content includs key metrics, market sentiment, short-term and long-term price predictions, technical analysis, investment potential, monthly forecast breakdown for 2025, risk factors, and historical performance. Readers will find actionable insights supported by verified data from trusted financial platform.

Table of Contents

1. Introduction

Advanced Micro Devices, Inc. (AMD) stands among the top semiconductor companies in the world. Trading on NASDAQ under the symbol AMD, the company is known for its microprocessors, graphics processing units (GPUs), and other semiconductor products. This article explains the AMD stock forecast based on current market sentiment, technical analysis, and comprehensive financial data.

The analysis covers both short-term and long-term views. It also includes tables, charts, and detailed comparisons. Readers will receive insights useful for various investment strategies.

2. Key Metrics & Market Sentiment

Key Financial Metrics

At the close of trading on March 21, 2025, AMD’s key figures were as follows (NASDAQ):

| Metric | Value |

|---|---|

| Market Capitalization | 172.48B |

| Revenue (ttm) | 25.79B |

| Net Income (ttm) | 1.64B |

| Shares Outstanding | 1.62B |

| Earnings Per Share | 1.00 |

| PE Ratio | 106.44 |

| Forward PE Ratio | 22.78 |

| Volume | 23,653,082 |

| 52-Week Price Range | 94.73 – 187.69 |

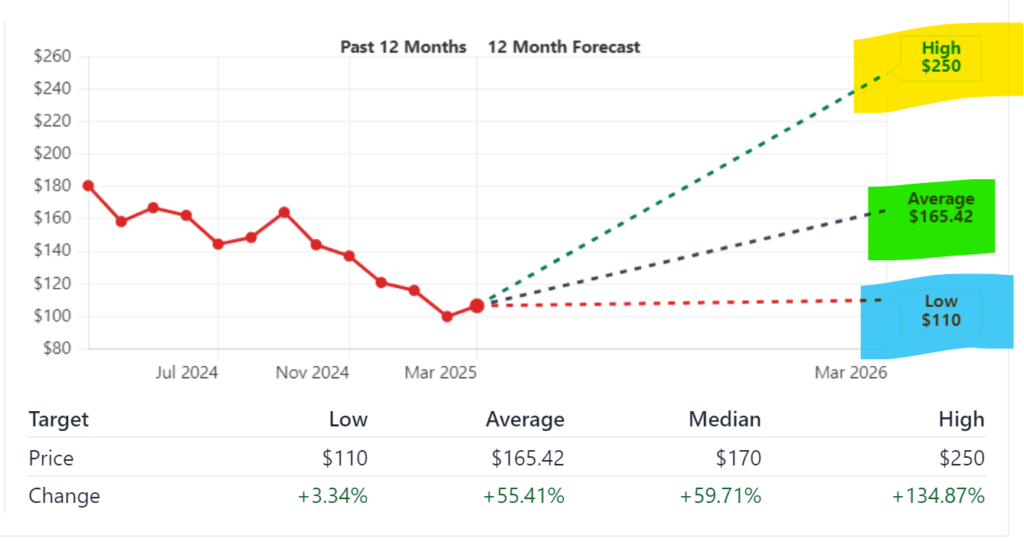

The data above reflects robust financial performance. Revenue growth and profitability have been encouraging. The market sentiment is generally positive. Most analysts rate AMD as “Buy” with an average price target of around $165.42 (Yahoo Finance).

Income Statement Overview

A summary of the latest fiscal year (FY 2024) income statement shows key trends. Data provided by S&P Capital IQ includes:

| Metric (in millions USD) | FY 2024 |

|---|---|

| Revenue | 25,785 |

| Cost of Revenue | 12,114 |

| Gross Profit | 13,671 |

| Operating Income | 2,086 |

| Net Income | 1,641 |

| EPS (Basic) | 1.01 |

The increase in net income by over 90% and improved EPS figures indicate strong operational performance. These numbers provide a strong basis for forecasting future price movement.

Market Sentiment

Investor confidence is supported by key metrics and positive analyst ratings. A majority of the 28 analysts surveyed have provided a “Buy” rating with an average price target of $165.42. Such consensus drives interest in AMD stock for short-term and long-term investment.

3. Short-Term Price Predictions (2025)

5-Day to 1-Month Forecast

In the near term, AMD stock is expected to show moderate upward movement. The short-term forecast considers recent price momentum, trading volumes, and market sentiment. For example, during the last trading session, AMD closed at $106.44 with a slight decline of 0.65%. However, the after-hours trading at $106.76 suggests minor recovery.

A 5-day to 1-month outlook projects a gradual increase in price. Analysts expect a rise in the mid-$110 range within the next month, based on current earnings momentum and market trends. Investors should note that short-term fluctuations may occur due to market volatility and news events.

Drivers Behind the Short-Term Forecast

Several factors influence the short-term outlook:

- Earnings Reports: Upcoming quarterly results may boost investor confidence. The earnings date is scheduled for April 29, 2025 (Yahoo Finance).

- Market News: Announcements related to product releases, especially in gaming and data centers, can drive immediate investor reactions.

- Technical Levels: Key resistance levels and moving averages provide support. These technical signals suggest potential entry points for short-term trades.

A brief table summarizes these factors:

| Short-Term Drivers | Impact |

|---|---|

| Earnings Releases | May drive stock to mid-$110 levels |

| Product Announcements | Positive news may trigger buying waves |

| Technical Support Levels | Provide entry and exit points |

4. Long-Term Price Predictions (2025–2030)

Yearly Forecast Summary

For the period 2025 to 2030, AMD is expected to see significant growth. The long-term forecast considers revenue growth, industry expansion, and the company’s strategic investments in technology.

Below is a sample summary forecast table:

| Year | Price Forecast (USD) | Year-over-Year Growth |

|---|---|---|

| 2025 | $115 – $120 | – |

| 2026 | $130 – $135 | 12% – 15% |

| 2027 | $145 – $150 | 11% – 13% |

| 2028 | $160 – $165 | 10% – 12% |

| 2029 | $175 – $180 | 10% – 12% |

| 2030 | $190 – $195 | 9% – 11% |

Investors and market analysts see continued expansion in the semiconductor industry as a driver for growth. The increasing demand for GPUs, CPUs, and AI accelerators supports this long-term growth trajectory.

Long-Term Catalysts

The long-term view of AMD is supported by several market catalysts:

- Technological Advancements: Continuous improvement in semiconductor technology drives product innovation.

- Data Center Expansion: Growth in cloud computing and data centers supports higher demand for AMD’s processors.

- AI and Machine Learning: Increased investments in AI-related hardware offer new revenue opportunities.

- Global Market Penetration: AMD’s aggressive market strategies are set to capture a larger share of the global semiconductor market.

Each of these factors is supported by current trends and forecasts from sources like S&P Capital IQ and NASDAQ.

5. Technical Analysis

Technical analysis plays an important role in forecasting price movement. This section reviews moving averages, momentum indicators, and volatility.

Moving Averages

Moving averages help smooth out price fluctuations. Analysts track both the 50-day and 200-day moving averages:

- 50-Day Moving Average: This indicator shows short-term price trends. A rising 50-day average suggests upward momentum.

- 200-Day Moving Average: This indicator highlights long-term trends. When the 50-day average is above the 200-day average, it signals a strong bullish trend.

Investors use these averages to determine optimal entry and exit points.

Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and MACD provide insight into the strength of current trends:

- RSI: A reading between 30 and 70 indicates balanced momentum. An RSI above 70 may hint at overbought conditions.

- MACD: The convergence or divergence of the MACD line relative to its signal line offers clues on trend reversals.

These indicators are useful for confirming price forecasts and identifying short-term corrections.

Volatility Analysis

Volatility measures like beta and the average true range (ATR) help assess the risk. AMD’s beta of 1.74 shows that its stock tends to be more volatile than the market. This suggests a higher risk profile in turbulent market periods.

A summary table for technical indicators is shown below:

| Technical Indicator | Current Reading/Trend | Interpretation |

|---|---|---|

| 50-Day MA | Rising trend | Supports short-term bullish sentiment |

| 200-Day MA | Consistently upward | Confirms long-term upward trend |

| RSI | Near 60 | Indicates balanced momentum |

| MACD | Signal line converging | Suggests a possible upcoming trend reversal |

| Beta | 1.74 | Indicates higher volatility relative to the market |

6. Investment Potential & ROI Scenarios

Investors can assess AMD stock using different time horizons. Each scenario is evaluated based on potential return on investment (ROI).

Short-Term Investment: 1 Month

In a one-month window, short-term catalysts include recent earnings, technical breakouts, and market sentiment. A moderate price increase is expected, with potential gains ranging from 5% to 8%. However, this period may also see price corrections.

Medium-Term Investment: 1 Year

Over a one-year horizon, AMD’s performance may benefit from product launches and quarterly earnings improvements. Given the analyst consensus and current momentum, a 10% to 15% increase in stock price is projected. This scenario factors in seasonal trends and technology sector growth.

Long-Term Investment: 5 Years (2030)

For a five-year outlook, AMD is positioned to capitalize on longer-term industry trends. Strategic investments in AI, data center expansion, and global market share could yield returns between 60% to 90% by 2030. This scenario assumes consistent revenue growth and successful execution of business strategies.

Below is a table summarizing the investment scenarios:

| Investment Horizon | Expected ROI | Key Considerations |

|---|---|---|

| 1 Month | 5% – 8% | Short-term market fluctuations and earnings reports |

| 1 Year | 10% – 15% | Quarterly performance, seasonal market trends |

| 5 Years (2030) | 60% – 90% | Long-term technological trends and strategic investments |

These scenarios provide a framework for investors considering AMD stock. Each timeframe involves distinct opportunities and risk factors.

7. Monthly Forecast Breakdown (2025)

A month-by-month forecast for 2025 highlights periods of potential growth and temporary declines. This breakdown provides a detailed view of the expected performance.

March 2025

March may see a recovery phase after the first quarter. Market adjustments after the holiday season and positive pre-earnings sentiment could drive AMD’s price to a near-term high. Technical signals suggest support levels near the mid-$110 range.

April 2025

In April, AMD is likely to report its quarterly earnings. The earnings release scheduled for April 29, 2025, may push the price upward if performance exceeds expectations. Analysts expect modest gains during this period due to increased trading activity around earnings announcements.

May 2025

Following the earnings report, price volatility may increase slightly as investors reassess the stock. Technical consolidations may form after a sharp upward movement in April. This period could provide an opportunity for value buyers if minor corrections occur.

November 2025

November typically experiences increased market activity as investors position for the year-end. AMD may show upward movement driven by holiday season demand for consumer electronics and data center products. Overall, November may continue the upward trend if quarterly results remain strong.

A summarized monthly forecast table is presented below:

| Month | Forecast Range (USD) | Key Factors |

|---|---|---|

| March 2025 | Mid-$110 range | Pre-earnings recovery and technical support levels |

| April 2025 | High-$110 to low-$115 | Earnings release and increased market activity |

| May 2025 | Consolidation phase | Post-earnings adjustment and technical corrections |

| November 2025 | Gradual rise to near $120 | Year-end market positioning and seasonal product demand |

8. Risk Factors & Market Dynamics

External Risks

Investors must consider global market trends, geopolitical tensions, and economic shifts. Changes in trade policies and international supply chain disruptions may impact semiconductor production. Additionally, fluctuations in demand for consumer electronics and industrial applications can influence AMD’s financial performance. Reliable sources such as Reuters provide insights on global economic conditions.

Internal Risks

Internal challenges include potential delays in product releases and increased competition from industry peers such as Intel and NVIDIA. Operational risks, such as manufacturing inefficiencies or technological setbacks, could affect performance. AMD must continue to innovate and maintain competitive pricing to sustain market share.

A table of risk factors is provided below:

| Risk Category | Description | Potential Impact |

|---|---|---|

| External Risks | Global economic changes and geopolitical events | Could disrupt supply chains and reduce demand |

| Internal Risks | Product delays, competition, operational issues | May lead to missed revenue targets |

Both external and internal risks must be monitored closely to adjust investment strategies.

9. Historical Performance & Analyst Ratings

Historical Stock Price

AMD’s stock history shows periods of rapid growth and occasional corrections. Over the past five years, AMD has experienced significant price increases driven by technology adoption and market expansion. Price volatility remains a factor due to the competitive nature of the semiconductor industry.

A historical chart from NASDAQ shows that AMD’s 52-week range has fluctuated between $94.73 and $187.69. This historical context provides a reference for future price targets.

Analyst Consensus

The consensus among analysts remains largely positive. With an average rating of “Buy” and a 12-month price target of approximately $165.42, market experts believe in the company’s growth potential. Several reputable sources, including Yahoo Finance, support this view. The consistency in analyst ratings underscores the confidence in AMD’s strategic direction.

Below is a summary of the analyst consensus:

| Analyst Parameter | Current Data |

|---|---|

| Rating | Buy |

| 12-Month Price Target | $165.42 |

| Consensus | Majority recommend buying |

The strong consensus is based on AMD’s consistent financial performance and growth prospects.

10. Frequently Asked Questions (FAQs)

What drives AMD’s short-term price movements?

Short-term price changes are influenced by earnings releases, technical indicators, and market news. Upcoming quarterly reports and product announcements may lead to price fluctuations.

How does AMD compare with its competitors?

AMD competes closely with companies like Intel and NVIDIA. Its strong performance in both data centers and consumer electronics gives it a competitive edge. Analyst ratings reflect confidence in AMD’s ability to capture market share.

What are the long-term growth drivers for AMD?

Key long-term drivers include expansion in data centers, advancements in semiconductor technology, and increased adoption of AI hardware. Strategic investments and global market expansion support a positive long-term outlook.

What risks should investors consider?

Investors should monitor global economic conditions, supply chain disruptions, and competitive pressures. Both external and internal risks can affect performance. Staying updated with reliable sources like Reuters is advised.

When is AMD’s next earnings report?

The next scheduled earnings report is on April 29, 2025. Investors should watch this date closely as it may impact short-term price movement.

11. Conclusion

The analysis of AMD stock indicates a promising outlook for both short-term and long-term investors. The current financial metrics and positive market sentiment support a gradual price rise over the coming years. Technical analysis reinforces the bullish trend, and a clear view of both external and internal risks helps investors make informed decisions.

AMD’s strong performance in a competitive market, backed by its robust revenue growth and significant technological investments, makes it a stock worth considering. Whether you plan to invest for one month, one year, or five years, AMD’s potential return on investment remains attractive based on the current forecast.

Final Thoughts

The semiconductor industry is undergoing rapid change. AMD stands in a favorable position to benefit from emerging trends in artificial intelligence, data centers, and gaming. With a healthy mix of technical and fundamental strength, the company’s stock presents various opportunities for investors with differing time horizons.

For further updates and deeper analysis, regularly refer to authoritative financial news sources such as Reuters, and consider monitoring AMD’s official releases on their website. Staying informed with up-to-date and verified data is essential for making strategic investment decisions.